Government entities means loans for FHA-recognized lenders so you’re able to remove the likelihood of losings when the a borrower defaults on their mortgage repayments. And additionally FHA, the federal government has also almost every other home loan programs in the manner from USDA Outlying Homes and Virtual assistant.

New FHA system was created in reaction towards rash out-of foreclosure and you will non-payments you to taken place in the 1930s; to incorporate mortgage lenders with enough insurance, in order to help activate brand new housing marketplace through loans available and you may affordable. Now into the 2022 FHA money are particularly well-known, especially which have very first-time homebuyers that have restricted currency spared to have off money. FHA funds don’t need a massive 20% advance payment like other conventional financing.

Normally an enthusiastic FHA loan is just one of the safest types of mortgages so you’re able to be eligible for because it requires the lowest down commission and you will have less-than-perfect borrowing from the bank. An FHA deposit out of step 3.5 % needs. Borrowers exactly who do not want a classic deposit regarding 20% otherwise cannot get approved getting personal mortgage insurance rates should look into whether a keen FHA loan is the better option for their personal circumstances. An additional benefit away from a keen FHA mortgage is that it may be assumable, and thus when you need to promote your house, the customer can assume the loan you have. People with lowest or bad credit, has undergone a bankruptcy proceeding otherwise was basically foreclosed upon is generally able to nevertheless be eligible for an FHA financing.

In basic terms… financial insurance policies. Since the a keen FHA loan doesn’t always have the rigorous requirements off a traditional loan, it entails several categories of home loan insurance https://cashadvancecompass.com/personal-loans-pa/delta/ costs: you’re paid-in full upfront otherwise, it can be funded toward home loan as well as the almost every other is actually a payment. And, FHA fund wanted the house meet certain standards and may getting appraised because of the an enthusiastic FHA-approved appraiser.

FHA Upfront financial top (MIP) – Correctly named, this really is an initial month-to-month premium commission, which means individuals pays a premium of just one.75% of the house mortgage, no matter what the credit history. Example: $3 hundred,100 financing x step one.75% = $5,250. Which contribution will be paid initial on closing as an element of the latest settlement charge otherwise might be folded to your home loan.

Single-house mortgage loans that have amortization terms of 15 years otherwise reduced, and you may a loan-to-value (LTV) proportion from 78 percent or quicker, will always be excused on the annual MIP

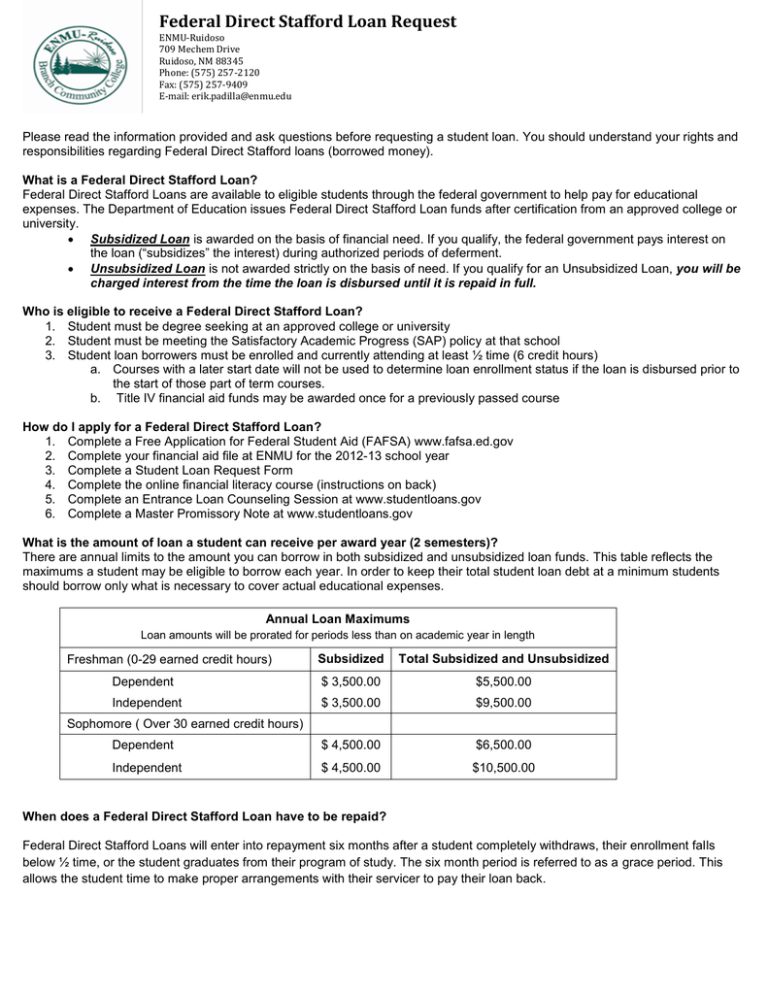

FHA Annual MIP (charged monthly) -Called an annual premium, this is actually a monthly charge that will be figured into your mortgage payment. It is based on a borrower’s loan-to-value (LTV) ratio, loan size, and length of loan. There are different Annual MIP values for loans with a term greater than 15 years and loans with a term of less than or equal to 15 years. Loans with a term of greater than 15 Years and Loan amount < or =$limit.

You’ll find limitation FHA loan limits you to will vary from the state

- The length of the yearly MIP will depend on new amortization term and you will LTV ratio on your loan origination big date. Excite refer to this MIP chart discover here to find out more:

You’ll find restrict FHA loan constraints that are different because of the county

- Need to have a stable a career history otherwise struggled to obtain an equivalent boss for the past 2 years.

- Must have a valid Social Cover count, lawful residency regarding U.S. and be out-of legal ages in order to signal home financing on your own state.

- Need to generate the very least advance payment out-of 3.5 per cent. The cash is skilled because of the a close relative.

- The brand new FHA loans are just readily available for top home occupancy, no resource or local rental property.

- Need a home appraisal regarding an FHA-approved appraiser.

- Your top-stop ratio (homeloan payment also HOA charge, assets taxes, mortgage insurance, home insurance) must be lower than 29 % of your revenues, generally. You might be able to get acknowledged that have just like the highest good fee due to the fact percent. Your own financial are required to provide reason as to the reasons they think the loan merchandise an acceptable exposure. The financial institution must were one compensating activities used in mortgage approval.

- Your back-stop proportion (mortgage plus your entire monthly debt, we.e., bank card commission, vehicle payment, student loans, an such like.) must be lower than 43% of one’s gross income, typically. You might be able to find recognized which have while the large good percentage as the per cent. Your bank are expected to add reason why they feel the borrowed funds gift ideas a reasonable exposure. The financial institution have to are any compensating issues useful for financing approval.

- At least credit history from 620 for maximum funding out-of 96.5%.

Assets must fulfill particular HUD standards: And additionally, an enthusiastic FHA mortgage requires that a house see certain minimum requirements from the assessment. Should your house youre purchasing will not see these criteria and you can a seller cannot agree to the required solutions, their only option will be to pay for the required fixes at the closure (to-be kept within the escrow through to the solutions was complete)

Very counties limitation fund to $420,680. In certain large-rates counties, you’re capable of getting funding for a financial loan size more than $800,one hundred thousand with a great step three.5 % downpayment. To determine the FHA mortgage limitations in your area, click the link.

Call us from the Ph: 800-743-7556 7 days per week. You’ll be able to only complete the fresh new small info demand with the right-side for the display screen to own an instant call-back.

Providing each of FLA River Urban area, Lakeland, Vent Charlotte, Sarasota, Tallahassee, Gainesville, Ocala, Daytona, Deland, Deltona, Winter Garden, Clermont, St. Augustine, Spring Slope, Winter season Retreat, Plant Area, Fort Myers, River Urban area, Destin, Fort Walton, Pensacola, Plant Town, Jacksonville, Orlando, Kissimmee, St. Affect, Brandon, Naples, River Town, Port Charlotte, Vero Seashore, Sebring, Fort Myers, Port St. Lucie, West Palm Seashore, Miami Fl, FHA Loan Direction, FLA, FHA Qualifying Guidelines