Emergency Deals Funds

Plus the advance payment, you should have at least 6 months of money easily accessible to fund cost of living and you may monthly homes can cost you. As a result you can shelter their month-to-month mortgage, assets taxation, costs, dinner, transport and you may insurance coverage to own six times. Making use of the a lot more than example, you should have $18,000 to $23,one hundred thousand on the crisis offers finance prior to purchasing property.

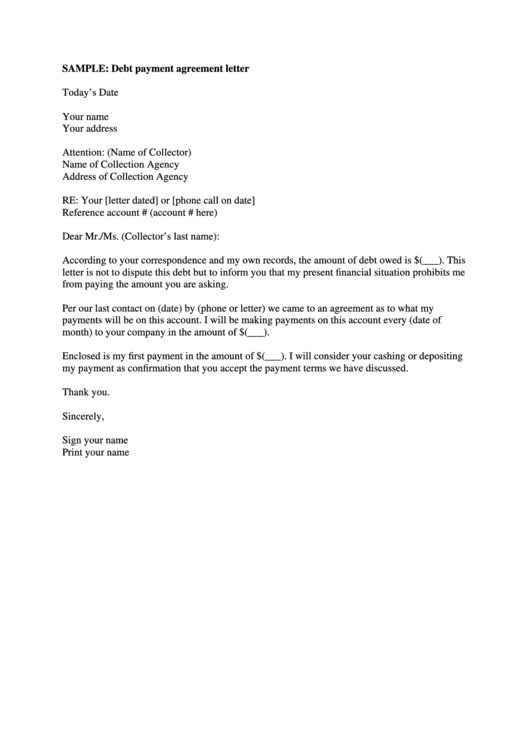

Pay off The money you owe

You will need to pay down the debt prior to getting into the a beneficial house, and you will generally you need to have paid off your financial situation at the minimal of half a year to a-year early looking a home. Loan providers want to see impressive credit rating, but they need credit scores and you can borrowing records that will be sub-standard if you make costs promptly and your entire financial obligation was reasonable than the your revenue.

Finances The Month-to-month Household and you can Repair Will set you back

If you pick a home, you’ll want to security house and maintenance will set you back along with bills. Your property may require certain fixes or renovations in advance of its able to possess relocate. You can even are interested in the newest chairs otherwise explore landscaping and you can pool maintenance features. It’s also wise to read the regular electric costs for the bedroom and see exactly how much other properties will definitely cost particularly Websites, wire and mobile. For those who have completely budgeted your monthly costs and it is nonetheless well in your mode, that means you might be financially prepared and ready to buy a property.

Bonuses for buying

There are a great number of bonuses for selecting property also advantage prefer, taxation incentives and you can equity. If you have lots of reasons for buying an effective house, it may be the best time to get into a special possessions, however also have to consider carefully your financial situation. These are merely a number of incentives for buying a different sort of house.

House Appreciation

Through the years, the worth of your residence will get boost. You may renovate and you can Raymer bad credit loans change your assets so that it keeps a high worthy of through the years. It extremely utilizes the latest housing industry. If you purchase property at a reasonable cost try a good rising housing market, you will probably be capable of geting big come back on your investment plus discuss all the way down rates later.

Mortgage Focus Write-offs

In the event the mortgage equilibrium try lower than the expense of your own household, you might subtract financial attention in your income tax go back. The attention ‘s the largest part of a home loan percentage. Other days, you can add home owners organization costs and you will property fees as part of one’s deductions.

Assets Income tax Write-offs

Real-estate fees purchased a first domestic otherwise travel house are also allowable on the taxes. But not you will find several claims with restrictions. Eg, California’s Prop a dozen restrictions assets tax grows so you’re able to 2 percent for every single season or a speed away from inflation in case it is lower than 2 per cent.

Investment Obtain Exclusion

When you have lived in your residence for a couple of away from 5 years consecutively, you may also exclude around $250,000 for someone or up to $500,000 in the event the hitched for each few funds getting money development.

Preferential Taxation Procedures

For folks who found score increased return on investment after you sell your property compared to the anticipate exclusion, it would be believed a funds asset for individuals who possessed the brand new house for more than a-year.

Collateral Bonuses

Owning a home in addition to enables you to make guarantee throughout the years. You could potentially funds your property advancements otherwise repay most other high notice costs particularly playing cards, medical costs and you may student education loans.