Using chattel financing to own are made land is continuing to grow within the recent years. 80% of new are built belongings bought in 2015 were titled since chattel. Just 34% of them have been placed in a produced home area and therefore 66% of new are built homes purchased in 2015 have qualified for a fundamental home loan but alternatively brand new homeowners signed up so you can forego permanent installations and you will went with chattel money. What makes a great deal more homeowners going with chattel finance more a traditional mortgage no matter if they have the brand new home in were created home?

On this page, we’re going to try to answer one to question and more. We shall defense the basics of chattel financing getting are manufactured residential property and research the differences between loans by way of an exclusive bank or a manufactured houses lender.

2 types regarding Financing for Manufactured Homes

There are 2 a means to financing a made house one another the newest and used. The very first is with a keen FHA otherwise traditional home mortgage and you will the second is a good chattel mortgage. Chattel money could be the hottest funds for everybody are designed house.

FHA and you will Traditional Mortgage loans to own Are manufactured Homes

In order to be considered a manufactured home getting an enthusiastic FHA or antique mortgage, it needs to be permanently installed on home owned by the individual purchasing the house and possess an installation filing registered.

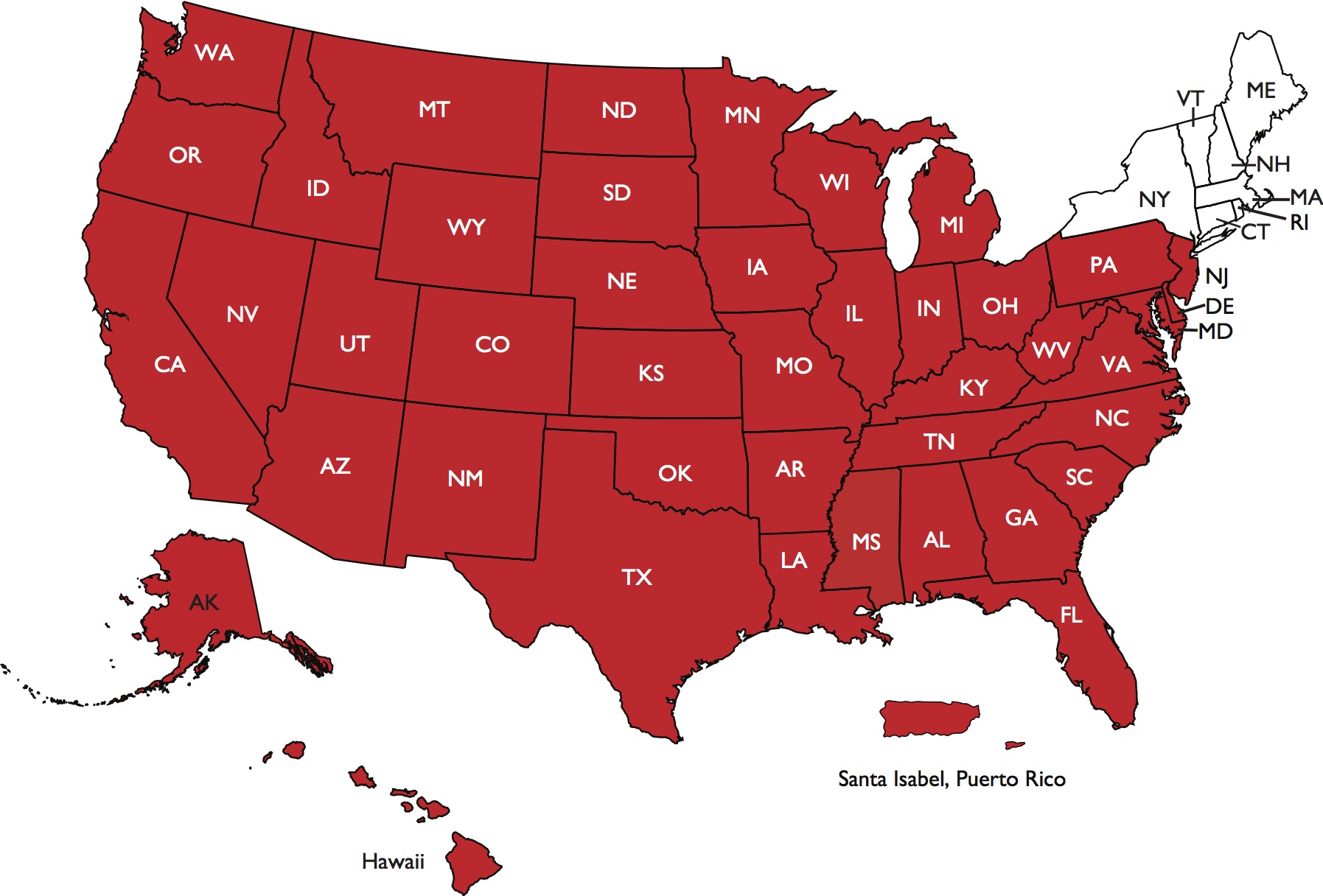

Within the 43 says, a produced house remains individual assets until the were created resident completes the fresh Conversion Techniques a legal means of electing to give and you may encumber a create dhome once the real property. In those states, entirely this new conversion procedure legitimately transforms new are manufactured the home of real possessions for everybody purposes. For this reason, missing eg a process, a created family will not comnstitute given that a fixture.

- Exactly how ‘s the family attached to your a house?

- What’s the intention of the home? (here is the the very first thing)

- Do you know the fixture and you can a residential property used for?

What is an enthusiastic FHA otherwise Conventional Financial?

If your family customer has their unique property possesses the domestic forever mounted on that property once the an installation, they may be able reclassify our home since the real property and you may qualify for an FHA or conventional home loan.

FHA mortgages are insured of the programs of your own Government Construction Administration. Whenever a loan is going to be insured because of the Federal national mortgage association or Freddie Mac computer lenders be a little more very likely to give.

A traditional loan isnt insured by authorities but by the individual payday loans El Paso mortgage insurance vendors (aka PMI). Speaking of some time better to get.

Average Terms and conditions to possess FHA and you will Antique Financial

Acquiring the family strung given that a fixture and reclassified because actual house is precisely the first rung on the ladder in getting an FHA or antique financial.

Both FHA and antique mortgages keeps large standards than just a beneficial chattel loan. Having FHA loans you ought to meet the lender’s criteria while the FHA’s. Listed below are just a few of an average conditions and needs to have a traditional mortgage:

- Candidate need 620+ credit

- As low as step 3% off

- Of up to thirty-six% loans so you can earnings rates (but can wade as high as 50%)

- 15, 20, otherwise 29- year conditions

- Maximum loan regarding $484,350 but could go of up to $750k in the locations including Los angeles

- Average Annual percentage rate is now anywhere between dos.88% and you can 5.75%

Defaulting on the an FHA otherwise Traditional Home loan

If the a created citizen features an excellent FHA otherwise conventional mortgage to the their residence and cannot afford the mortgage there are several actions ahead of repossession happens that will covers the brand new resident.

First, the lending company must provide homeownership guidance notice and implement a mistake solution process. Next, they want to adhere to restrictions linked to force-put insurance coverage, pursue early intervention requirements, and provide to have a single section away from get in touch with to have losings minimization. (Fannie mae, )