In recent times, Us americans has watched real estate loan rates plummet to help you usually lowest accounts, prompting of a lot home owners so you’re able to re-finance its current mortgage loans. These re-finance loans serve to exchange homeowners’ current mortgages which have the newest money and you may the fresh terms and conditions, often letting them protect down rates of interest and even cash-out on the residence’s situated collateral.

Having interest levels start to go up again, yet not, others could well be thinking if this sounds like however an enjoyable experience so you’re able to refinance lenders – or if it creates much more sense to attend. So, let’s have a look at in which mortgage re-finance rates already sit. We’re going to and break apart exactly how they will have altered lately – and just why a re-finance can still become worthy of pursuing.

If you think you might benefit from refinancing their mortgage after that contact a mortgage elite group now. Begin spending less today before costs rise once again.

Just what home loan re-finance rates are

Predicated on study on the Government Set-aside Financial from St. Louis, the average mortgage interest rate in early is actually 6.66% for the a thirty-seasons fixed-price loan.

When you find yourself financial refinance costs may vary some away from home loan origination loan cost, this type of number let you know a trend that is important across the board: home financing refi can cost you so much more in the notice now than just it would possess per year otherwise two before.

An elementary mortgage loan financing are a payment-mainly based financing you to runs often fifteen or 30 years long. Homebuyers can pick ranging from a predetermined otherwise changeable interest, and that establishes exactly how much you to house purchase loan will cost him or her over the course of you to definitely payment.

If the sector interest levels change amongst the big date financing is began (opened) if in case it is paid back, though, it can commonly sound right in order to re-finance the whole loan. This refi requires the area of unique mortgage mortgage, preferably with a lower rate of interest and better payment words.

Financial re-finance rates inside peak of your pandemic

Inside the pandemic, interest rates into home loans dropped on the lowest wide variety we’ve ever before viewed, then spurring new influx away from homebuying (and you can decreased sector index) that’s only now begin to slow. Within these pricing bottomed away just 2.65%.

That have interest rates it lower, it simply produced feel getting a slew out of homeowners to help you jump from the window of opportunity for a home loan refi. And of course, that is what taken place. Centered on analysis throughout the Consumer Fund Safeguards Bureau (CFPB), there had been more than four times fast cash loans North Courtland AL as numerous refinance finance originated for the 2021 than in 2018.

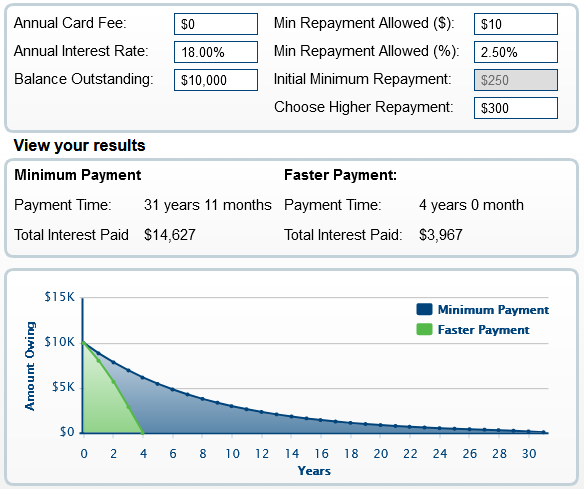

But when you are cost are not any longer this lower, of several property owners can always find value when you look at the refinancing their house financial finance now. Make use of the calculator lower than to help you crunch new number observe just how you will be capable benefit.

Why refinancing a mortgage has been really worth looking for

Although not, it is critical to remember that mortgage refinancing loan can always feel a wise financial choice now. After all, whenever you are financial prices is large today than simply they certainly were within the 2020-2021, he or she is still reasonable by the historical conditions.

In the year 2000, the typical mortgage interest reached a top out-of 8.64%. Regarding middle-1980s homeowners saw prices of up to %. Within the 1981 prices was in fact resting anyway-time levels of %.

At the conclusion of the afternoon, the decision to refinance a mortgage loan depends on your specific mortgage conditions and you will needs. When the today’s pricing is actually lower than you are spending towards the a current home loan, refinancing may potentially help save you a lot of money inside appeal, get rid of the payment, get household repaid shorter, otherwise all around three.

The goal of good re-finance isn’t really simply for cutting your notice price, either. Property owners may also utilize a finances-aside re-finance to get off their house’s equity, especially if they may be able lock in a competitive speed. It currency are often used to repay debt, loans a house restoration, or coverage large expenses such college tuition or a wedding.

Not one person knows exactly what interest levels does moving forward, otherwise exactly how high they’ll rise. If you’ve been considering refinancing your home loan, the optimum time to take action may still end up being today.