Purpose Analysis

The fresh new FY13 baseline amount for Emergency Loan application Come back Price was 24%, so that the mission to possess FY14 will be to achieve 31% and you can 34% within the FY15. Enhancing the app get back rate often help the beginning of your own Disaster Mortgage System. The key chance being addressed is that increased app get back price should end up in a lot more disaster survivors one to tend to submit an application for emergency financing guidance and you may located much needed Federal disaster guidance. SBA’s plan to improve app come back rates together with ensures that SBA’s disaster direction resources to possess businesses, non-funds groups, residents, and you can clients can be deployed rapidly, efficiently and effectively so you can maintain efforts and help get back small businesses to procedure.

SBA’s plan to increase the application go back rate tend to indirectly make the newest Crisis Loan Program more efficient by: 1) preserving costs with the emailing application packets to help you a hundred% away from disaster https://paydayloanalabama.com/cullomburg/ survivors referred to SBA; and you can dos) releasing upwards information intent on planning and emailing app boxes that can be utilized various other critical aspects of the applying testing procedure that personally feeling operating times.

Tips

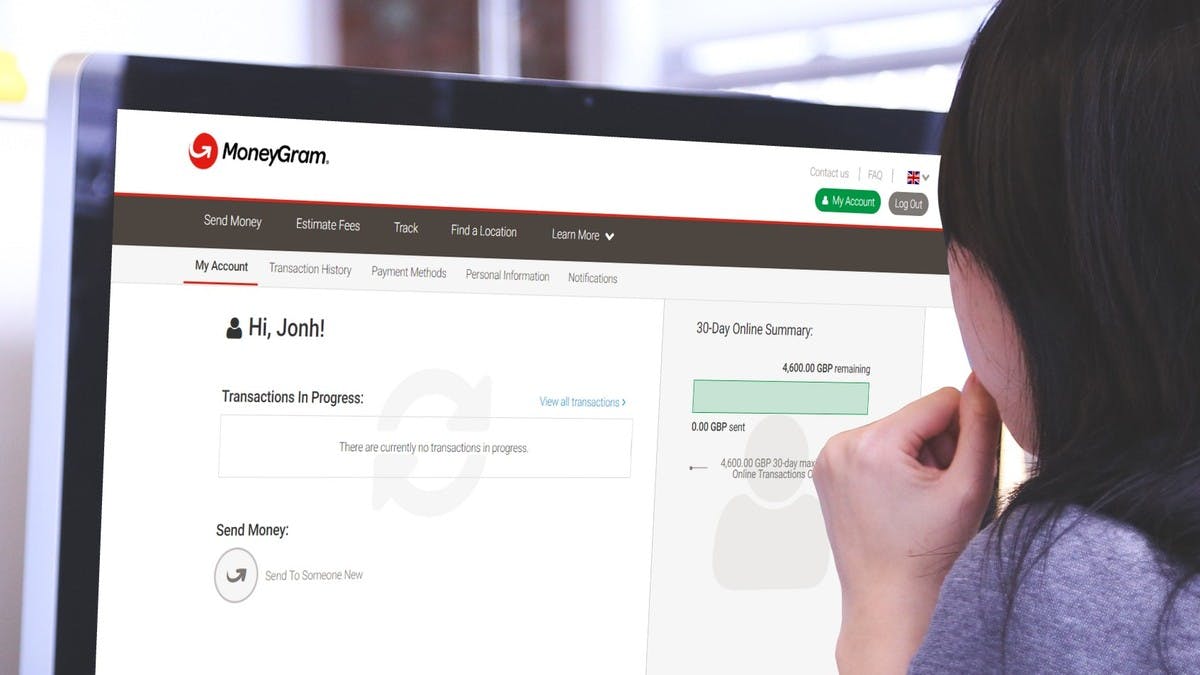

SBA will positively in order to disaster survivors. We’ll talk about way of and make with the-line accessibility Electronic Loan application (ELA) and you may program advice offered in order to crisis survivors. Office regarding Disaster Recommendations usually upgrade ODA’s sale to increase personal expertise in SBA’s disaster software, that have focus on lead website links towards the ELA software. We shall benefit from journalism to attract interest in the newest Disaster Financing System and gives fast access to disaster survivors. The general strategy could be geared towards all of our internal lovers and you will the fresh external readers away from crisis recommendations.

The application get back rates is basically affected by the footprint of private disasters as well as the variance in type of crisis (flood, piece of cake, flame, etcetera.) and statement brands (Presidential-Iindividual Advice, Department, Economic Burns off Emergency Mortgage (EIDL) only). SBA have a tendency to display the latest impact these contextual indicators enjoys to the the general improvements of your own top priority objective to increase the program come back speed.

We’re going to in addition to go through the get back rate to see if there is people effect on objective completion based on venue regarding the brand new crisis, measurements of the crisis and kind of the disaster.

- Emergency survivors’ reluctance to help you obtaining Federal disaster financing assistance, maybe due to the following the grounds: unwilling to make an application for extra loans; display financial suggestions, pledge equity so you’re able to secure financing otherwise standard concerns more unclear recuperation of local cost savings.

- Disaster survivors can also be reluctant to make an application for crisis loan guidance in the event that other companies with an increase of prominent terms (e.grams. features, forgivable finance, etc.) are available to him or her.

Advances Revision

The process developments out of early in the day financial decades (i.e. implementing separate software songs to have household and you can business loans, usage of digital applications) permitted the SBA in order to efficiently get to a premier Application Get back Price when you look at the FY 2015. Plus applying a new processes having giving software so you can crisis survivors into the Presidential disaster declarations to own Private Direction (IA), SBA hit an emergency application for the loan return speed off 98%. Ahead of FY 2014, SBA shipped a disaster loan application every single private and you will team you to definitely registered that have FEMA and you may labeled SBA to have emergency mortgage advice. Now the fresh ideas from FEMA is contacted because of the phone thru Disaster Secretary Support service Center’s automobile-dialer and offered the options out of applying to the-range, implementing when you look at the-person or applying of the post. The individuals not called located a letter explaining the various solutions having using.

In most financial residence but you to definitely out of FY 2014 courtesy FY 2015, the SBA enhanced the latest emergency application for the loan come back price, supposed out-of 24% at the conclusion of FY 2013 to 98% after FY 2015. The brand new SBA enhanced emergency advice of the partnering user-amicable tech and streamlining the borrowed funds app processes. Instance, new electronic application for the loan rate risen to 84 per cent within the FY 2015, more than tripling the pace from FY 2011. The fresh SBA is consistently examining and you can implementing procedure advancements to compliment system beginning and you can increase the customer sense. Eg, the fresh digital application for the loan (ELA) having disaster guidance loans keeps simplistic the mortgage app procedure, racing beginning of assistance to qualified crisis survivors and you can increasing the ethics of information included in the brand new underwriting processes via the Emergency Borrowing Management System (DCMS). In addition to, SBA centered calculate loan operating time requirements centered on tiered profile from application volumes (from lower than 50,100000 apps so you’re able to more than 500,one hundred thousand programs) which will surely help SBA better carry out consumer requirement in line with the number of disaster interest.