The fresh new lifetime of home financing inside the The fresh Zealand is oftentimes ranging from twenty-five so you’re able to thirty years. As the home loan persists such a long time, even though rates was relatively reduced, you find yourself purchasing comparable number back to attract since you have lent within the dominating. If you look at the infographic in the next area, so as to once you borrow $three hundred,000 more 3 decades within 5.45%, you wind up repaying $609,533 overall.

Wow, $309,533 simply in the attention payments, that is more that which was lent initially! This is the real price of a mortgage; it continues a long time, you find yourself make payment on home loan off twice – shortly after for the dominant and when for the attract.

Just what perception do to make a lot more costs has actually?

I experienced an improve and get $fifty dollars leftover each week, very which is $100 for every single 14 days additional I could placed on my personal fortnightly repaymentsparing the two problems below reveals the way to really acquire worthy of out-of leading more cash into your home loan. Cutting an astonishing five years and you may 10 weeks off of the financial lifetime and you may a saving from $65,365 into the focus. An important is that you shell out desire to possess a shorter several months of your energy which means a notably quicker loans.

Just what otherwise can i envision?

There is no question the data a lot more than let you know the work for of getting even more funds into your financial but that doesn’t fundamentally indicate when you find yourself in this condition you have to do it, there are more points to consider.

The additional finance can get serve you better if you put all of them towards the strengthening a good diversified investment collection, this may shield you from business specific unexpected situations. Financing potential eg Kiwisaver will be a wise the means to access currency more than their mortgage and you will livings will cost you.

There are a lot of a few as well as the decision all depends your way of life and you may specifications about small so can i get a loan for my tax refund you’re able to a lot of time term coming. If you find yourself in this standing and you are being unsure of what the finest path is you will be seek advice from a qualified economic adviser.

Additional Mortgage repayments Conclusion

- Even more home loan repayments = less money debt, shorter incentives, smaller time for you becoming mortgage 100 % free that is great.

- You can also overlook almost every other financial support solutions if you appeal only on your financial.

- Extra cash paid off with the home financing most often cannot be withdrawn if you need it once more rather than a mortgage reconstitute.

And work out extra payments on top of your month-to-month costs helps you pay your own financial reduced while using reduced desire. Therefore some thing more you spend during that time will reduce the primary matter, so you might possibly be paying rates of interest on your financing to possess a smaller timeframe – it indicates your shorten the life span of mortgage and reduce the desire costs.

Costs such as for instance; Application/Place, Annual bundle, Monthly, Launch, Valuation, Court and you can Settlement can be expected whenever going through the procedure and receiving financing.

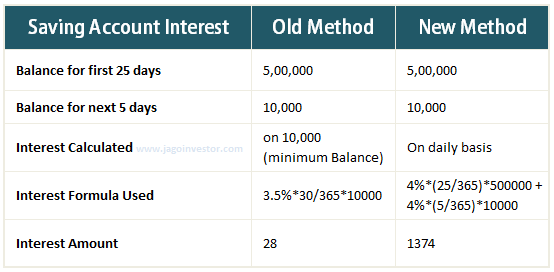

It all depends toward personal, and you may whatever they normally manage inside their funds. Yet not, it ought to be listed one to notice into mortgages has a tendency to accrue every day, thus preferably, paying each week could save you a great deal more focus than simply paying down fortnightly. Per week and you may fortnightly payments have a tendency to get a lot better than paying month-to-month fundamentally.

Financing Contract is actually an extremely detailed listing regarding a loan between the debtor and you may bank that always has information regarding exactly how the mortgage will be paid and if. A loan Arrangement as well as directories the latest commitments each party features with regard to the loan, such as the mortgage costs plan.

A predetermined interest is but one that’s repaired, or secured during the, at this count and will not changes to have a-flat months – as opposed to a drifting otherwise varying interest. That have fixed rates home loans, brand new fixed several months is normally from a single to help you five years. It indicates their regular mortgage payments are still the same during this months.