Citizen. You sustain the cost of keeping your house you possess. In the event that things stops working, since resident you have got to remedy it.

Tenant. You aren’t responsible for preserving your home or apartment whenever it comes to replacement manager-given equipment, repairing plumbing situations, paint, otherwise restorations. As with fees, your own lease include the latest landlord’s estimate of cost of restoration but in the finish, the new landlord try legally necessary to take care of the possessions.

Insurance rates

Citizen. Homeowners insurance should cover the dwelling along with damages for the reason that h2o otherwise fire and all sorts of a homes. It ought to also have responsibility visibility. Just like the homeowners insurance needs to render way more exposure than just clients insurance policies it can prices as much as eight moments the cost a renters rules.

Occupant. Clients insurance is less expensive than home insurance since it simply covers the price of your property, maybe not this building in which you reside. In addition it boasts individual liability insurance rates though someone is injured on possessions and it is your own fault.

Equity

Homeowner. Because you individual your house, people like inside the value (equity) is a. Really house boost in worth throughout the years even when, like all assets, may belong worthy of. When you promote the home, you can profit one security since cash. It’s not necessary to wait until your sell to apply out of collateral, although not. You could potentially borrow on the newest collateral you may have collected using a great style of financing choice including a property collateral mortgage, family collateral credit line otherwise HELOC, or a cash-aside re-finance of home loan.

Occupant. You don’t earn equity (otherwise treat they) because you do not individual our home or apartment where you live. Equity, or even the rise in well worth a property get over time, merely goes toward the person who possess the home.

Lifetime

Homeowner. If you want the space your geographical area, are generally ready to accept about three to five many years, establish root, and maintain a comparable jobs, becoming a citizen tends to be a good fit to you.

Renter. For individuals who a lot of time to call home elsewhere, use up all your occupations shelter, aren’t ready to stay static in place for at least around three many years lowest, renting could make far more feel to you personally today.

Reassurance versus. self-reliance

Citizen. When you very own property, it cannot end up being offered instead of your own permission (given you keep and also make payments timely). When it peace of mind resonates firmly with you, homeownership is getting in touch with.

Tenant. Renters change new peace of mind control provides for the self-reliance to without difficulty relocate to another area. As long as Florida personal loans that freedom is essential to you, renting can be a better selection, at least for now.

Funds

Citizen. To find property, you will want to employ a good amount of economic leverage. Your 20% down-payment and good credit score get to be the control you to will get you a loan to possess property really worth a couple of times the quantity your shell out. Getting one to influence debt house needs to be in the buy. You need you to definitely deposit, good credit, solid work, and financial wherewithal while making domestic payments on time for this new near future.

Tenant. The economic conditions for leasing commonly since rigorous having tenants, nonetheless they commonly low-existent. To help you rent a property, you want the amount of brand new deposit, a good credit score, in addition to ability to generate book costs timely.

The expenses away from leasing vs. getting

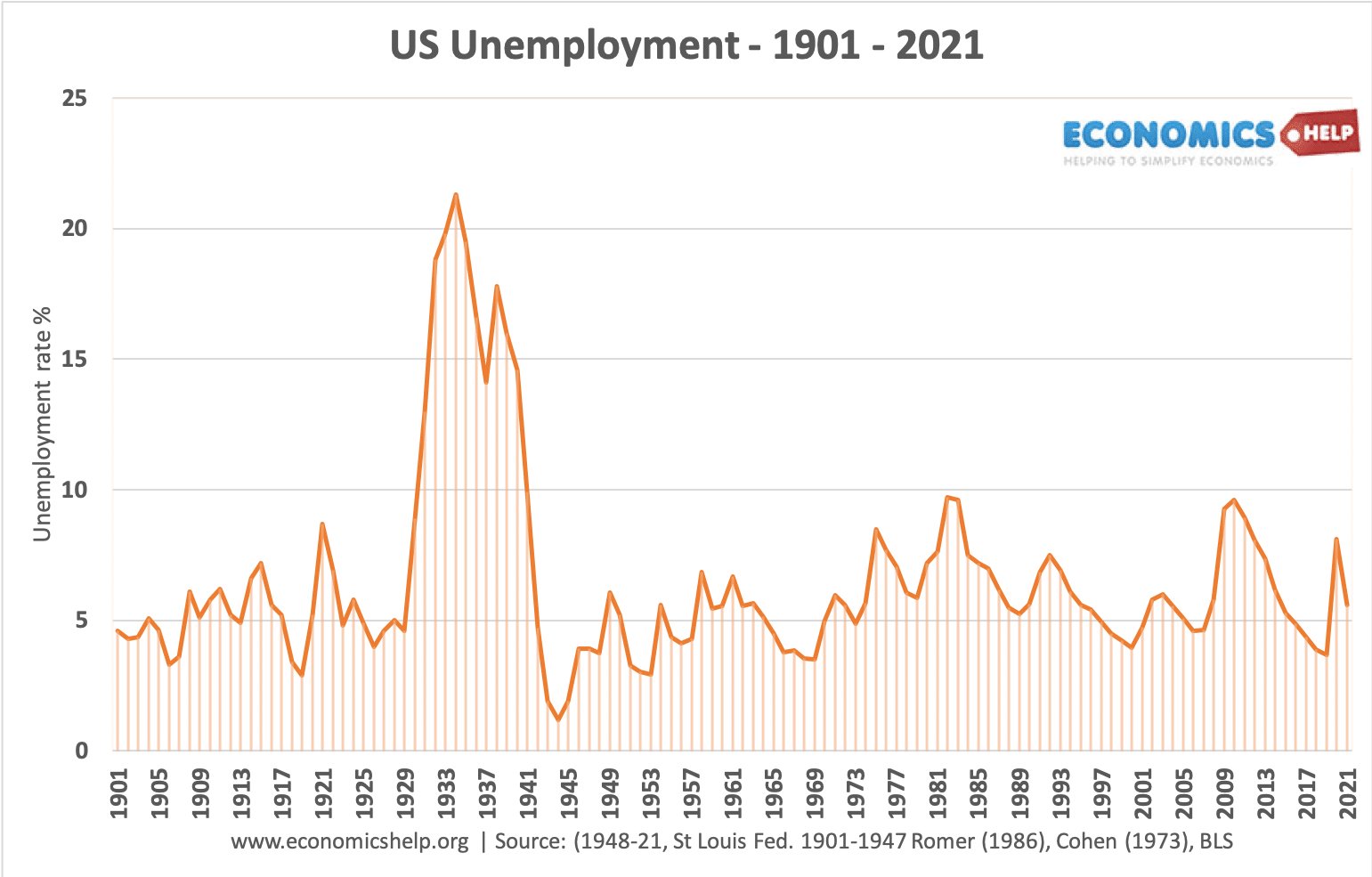

The expense of renting vs having depends mainly about how long your stay-in an identical family of course, if economic points pursue historic trend.