If you find yourself looking to buy your earliest family or apartment, probably the most overwhelming the main techniques to you can be seeking your first financial.

There are many the brand new guidance to take on board, but here i split it as a result of allow it to be easy to see.

What does a large financial company do?

Your large financial company was an independent wade-ranging from whom scours the entire financial market to discover the most suitable mortgage for your requirements, and you can maximise your chances of a successful software.

To begin with, a mortgage broker can save you currency by the pinpointing a knowledgeable deal with a decreased interest levels and/otherwise lower fees, or reduced log off penalties, otherwise almost any most other criteria allow it to be most suitable and you may reasonable to have you.

Next, your own broker makes this option according to most of the income available, and certainly will gain access to some special representative only’ sales that you will never select direct away from people seller otherwise for the any rate research websites.

Thirdly, the agent is not associated with one sorts of organization, therefore can provide you with unbiased suggestions about an educated contract for you, no disputes of great interest.

Fourthly, their agent often direct you through the entire process to be sure that your software program is as solid and over as you are able to succeed, adjust your chances of becoming acknowledged very first time.

Of a lot mortgage broker readers possess stated it just like the provider it valued very with people to guarantees and you will tell them throughout the that it significant lifetime decision.

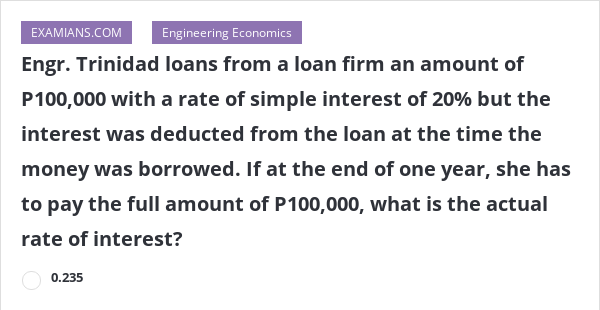

Payment or notice just

This can be an important point, since you need certainly to still pay-off the full loan by avoid of one’s home loan name.

If you don’t have a lump sum accessible to accomplish that, that you will find to market the house to pay off the loan.

Interest-simply mortgages are taken out by landlords to acquire property in order to let, since they can sell the property after the new home loan term to pay off the loan.

The mortgage package

Their financial contract the most keys. So it establishes just how much attention you have to pay into the mortgage, and you will even in the event that it price is fluctuate (and when so, by how much).

A home loan offer, such as for example a predetermined speed, can last for a limited several months particularly two, three or five years (sporadically a great deal more).

Mortgage charge

Often you will have to pay particular costs when starting good financial, ranging from a few hundred to a few thousand lbs.

There can charge getting leaving the financial (we.age. remortgaging or spending it well) prior to a certain the years have elapsed. Many business features a tie-inside the months, which are often more than the offer several months by itself.

This may need you to spend at least a year for the this new lender’s standard variable speed (SVR) unless you are ready to spend the money for charge.

Historically shorter places was in fact accepted, nevertheless when there’s more uncertainty throughout the market, an excellent 10% put (having a beneficial 90% mortgage) are the minimum needs.

Generally, the bigger your put, the higher product sales you can aquire. Having a much bigger deposit you happen to be provided down rates of interest and maybe as well as extended-lasting selling.

They may struggle to find an effective ninety% financial with sensible interest rates. not, if they manage to find an extra ?ten,000 then they would have a great 15% deposit and create just need a keen 85% home loan.

This would mean they’d need to borrow faster (?170,000) that would be much more affordable, and might also get straight down interest levels to their mortgage price.

Brand new financial marketing usually are offered by the 5% endurance i.e., an excellent fifteen% deposit can get you ideal deals than just an effective ten% that, but an excellent 14% deposit would not.

Thus for folks who simply have a 5% deposit, the fresh new system can help you safer good 95% financial, possibly checking much more chances to get on the home hierarchy.

Just in case you can just only would a smaller sized deposit, the loan Guarantee Scheme and its own recommended successor, Independence to find you can expect to provide valuable routes so you can homeownership.

Yet not, it is important to believe why these mortgage loans may come that have highest rates and you will costs than others having large places.