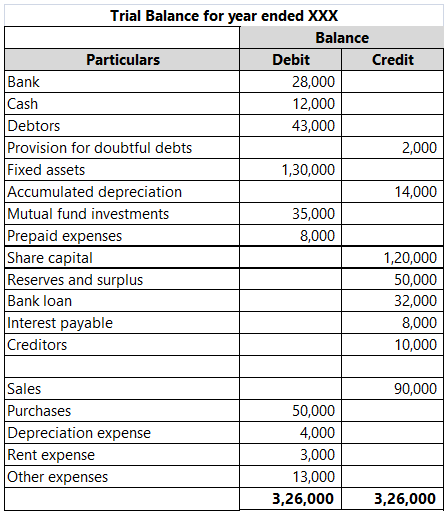

Figure step one

The low portion of college students whom borrow is the one good reason why Ca enjoys a track record for sensible college or university. Michael T. Nietzel, Hence Says Have the The very least And most Pricey Public Universities? Forbes, //which-states-havethe-least-and-the-most-expensive-public-colleges/. “> 8 However, this does not mean Ca try to come about other areas, that declaration will mention. In lot of respects, the state measures up even worse than really other people.

The latest Bad news

While you are California is actually better-considered for the sensible personal advanced schooling, the state is in a more precarious condition than other claims collectively a few key components of the new beginner debt crisis: higher average personal debt balance, the responsibility from obligations with the nation’s Black colored parents, the organization from high-risk scholar debt, and also the country’s dependence on parent-kept loans that is so very hard to own family to repay. Nowhere is actually these themes while the pronounced since the as soon as we check the state’s for-profit college or university business.

Figure dos

For many consumers, stability slide right up once the appeal ingredients. But an alternate biggest push driving upwards California’s mediocre is actually highest borrowing from the bank number those types of who take aside financing, having scholar debt and you will father or mother obligations getting prominent serious pain-things.

The typical annual scholar mortgage try big during the Ca versus nation overall. California’s for the-state graduate college students whom borrow average $28,three hundred into the funds a-year compared to $22,eight hundred in america full, a great twenty-six % disparity. Source: author’s research of information in the Federal Postsecondary Scholar Support Study, through the National Heart having Education Statistics. Come across Figure 3 on the partner report . “> 11 In the Grad Along with program, a federal education loan program to have graduate youngsters, California’s average yearly loan try 25 percent greater than the average along side remainder of the United states; the fresh new gap shoots to 43% large some of those credit to visit getting-profit universities. Source: author’s data of information throughout the Federal Scholar Support Research Cardiovascular system. Select Shape 1 in the companion report . “> several It is such as for example distressing because Graduate In addition to program features an enthusiastic outsized footprint for the Ca, comprising 24 percent away from student loan dollars disbursed regarding county into the 2021twenty-two, instead of only fourteen per cent for the rest of the united states. Source: author’s research of information regarding installment loans South Dakota the Federal Student Support Data Cardiovascular system. Pick Table step three on spouse statement . “> thirteen

The next parts talk about the newest security ramifications out-of hefty credit by the California’s categories of colour, in university and you will on the cost, and you can think about the much time-identity inquiries as a result of Plus obligations for the Ca.

Racial disparities throughout the outcomes of education loan borrowing from the bank indicate if education’s mission so you’re able to level the fresh new play ground was know, or whether or not noneducational circumstances such as wealth disparities corrupt one to purpose through college will set you back and you will student loan obligations. On the adopting the study, we see one to irregular reliance upon education loan debt because of the battle ong California’s borrowers so you can a much better studies than in the latest nation full.

Desk step one

Data from the studies reveal that Black colored pupils much more most likely in order to use than simply pupils off their racial/ethnic groups, and this, prior to the rest of the country, California’s Black borrowers in fact food even worse when you look at the repayment, in spite of the state’s aggregate money and its seemingly sensible personal knowledge to have undergraduates.

Latino/a borrowing pursue a similar activities once the Black credit collectively some variables, however the. Analytics into California’s Western populations commonly tune which have analytics into new state’s white inhabitants, while this is not to imply their feel that have university can cost you are the same. Test size limits along with limit just how much we can glean of established datasets. (Much more breakdowns by the class are available in the fresh partner declaration.)