Higher financing wide variety: SoFi’s mortgage amounts include $5,000 so you’re able to $100,000. This is about double the maximum amount borrowed provided by most of SoFi’s battle.

Look at cost rather than affecting your credit score: Like many on line lenders, SoFi can use a silky credit assessment that doesn’t hurt your credit rating to show your what cost your prequalify having. It is really not if you do not plan to accept SoFi’s render that the financial operates a hard credit assessment to verify your details.

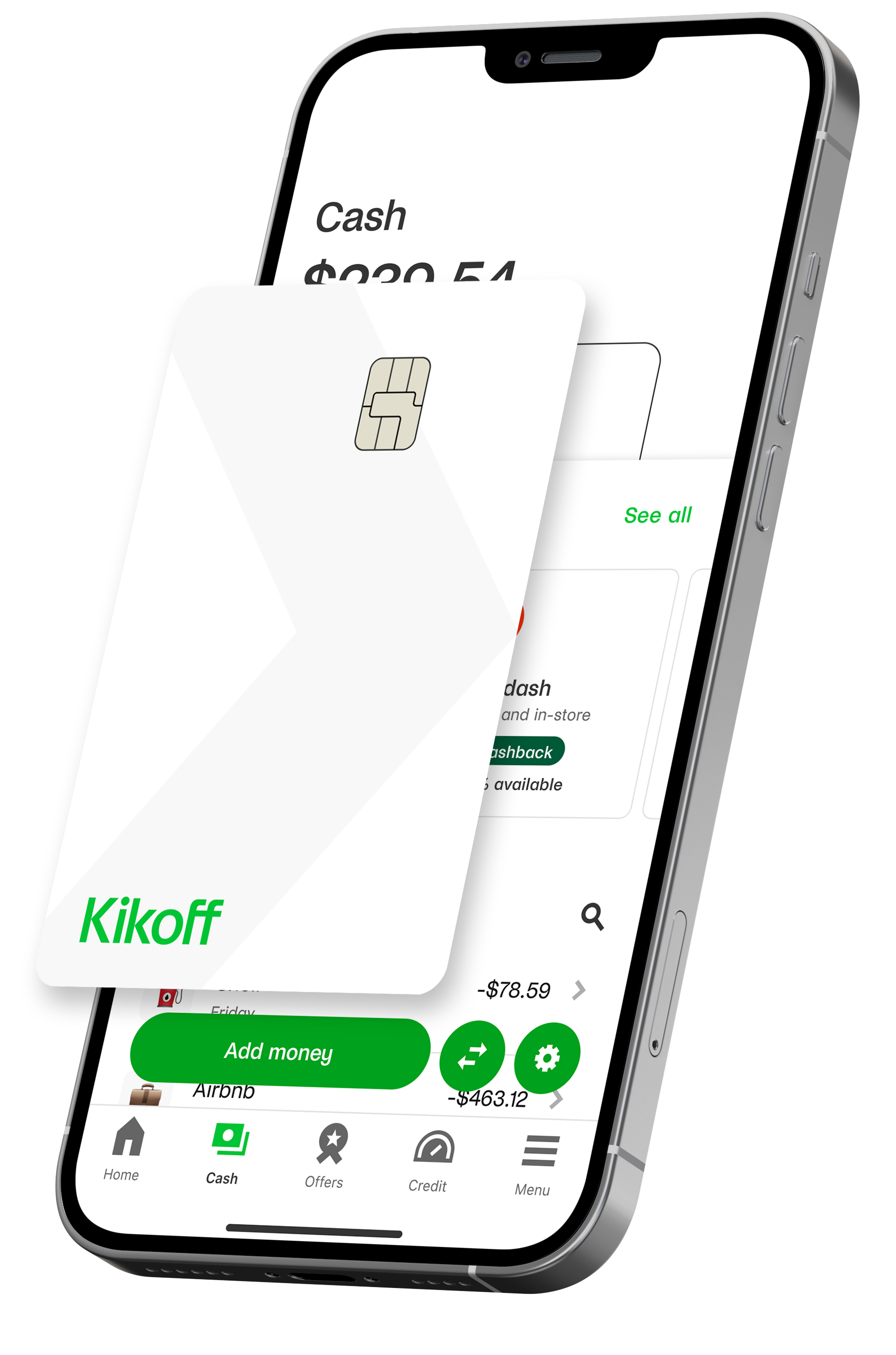

Easy-to-play with mobile application: SoFi allows you to do team no matter where when you want through providing an enhanced, user-amicable cellular app one to lets you borrow, purchase, and you will help save. It can be utilized to check your own rates thereby applying getting financing, together with take control of your SoFi Invest account and you can SoFi examining, offers, and you may loan account.

The means to access associate professionals: SoFicalls its people professionals. You get over financing after you borrow of SoFi. Given that a part in addition, you score totally free use of unique benefits particularly economic think, together with deals regarding estate believed attributes. SoFi together with plans representative enjoy and you may usage of the fresh new Member Couch in the SoFi Arena.

Co-consumers are allowed: SoFi lets co-people with the unsecured loan programs, if they real time in one address while the top candidate. Good creditworthy co-borrower increases their odds of recognition for a loan in the total amount need.

Just what could be improved

Far more varied loan quantity: SoFi will be a more flexible loan provider when it provided finance so you’re able to borrowers searching for below $5,000. If you would like that loan to fix broken pipelines otherwise change several windows, you’re probably not seeking an effective $5,000 financing.

- A good credit score, or aFICO Get out-of 680 or higher. The typical SoFi debtor keeps a credit rating out of 730.

- A keen acceptabledebt-to-earnings proportion (DTI). In case your month-to-month debt burden currently account for a big chunk of the income, it is a warning sign getting lenders.

- Higher education and you will a strong works record. SoFi considers these a great predictors regarding borrowers’ upcoming ability to shell out.

- High money. The typical SoFi customers provides a half a dozen-shape annual money.

As you can plainly see, SoFi’s mortgage acceptance is dependant on more than just your existing money and you will credit score. The business prides in itself to the their novel method of underwriting and you will considers issues including the borrower’s education, top-notch background, and much more.

For individuals who qualify for good SoFi personal bank loan, you ought to have the funds within a number of working days. Typical financing money a similar big date and/or 2nd team big date.

- Credit card combination financing

- Do-it-yourself financing

- Relatives believe expenditures

- Medical expenditures

- Wedding costs

You cannot have fun with a personal loan for only something. Most of the lenders impose particular restrictions exactly how the latest proceeds tends to be put. If you prefer currency the real deal house, company motives, expenditures, purchases of ties, post-supplementary studies, or small-identity bridge investment, you cannot installment loans online in Missouri use a SoFi loan.

Same-go out investment: At SoFi, popular personal loan programs created before eight p

For folks who curently have good SoFi financing, you are eligible to get a moment mortgage after you have produced around three successive arranged money on the basic loan, for as long as the complete a good stability usually do not go beyond this new $100,000 limitation. Michigan customers may only get one SoFi financing at once.

Applicants who don’t meet the requirements can get re-apply which have a co-debtor, as long as that person lives in one target. If the recognized, one another co-individuals might be totally liable for the debt. Co-borrowers e from the loan, you have to pay it off or re-finance they having good the latest mortgage in your term just.