This new Government Casing Management, and/or FHA, try a national-work at institution giving insurance coverage on the FHA-accepted mortgage loans, so you’re able to raise affordable casing in the U.S.

FHA home loans keeps a collection of rules and you can recommendations and therefore using lenders need to realize to ensure that fund to-be covered because of the United states regulators. This type of legislation is actually collected in a single site guide entitled HUD 4000.step one.

To be eligible for an FHA-acknowledged loan, you might be needed to pay home financing cost. That it insurance coverage protects loan providers of incurring a loss of circumstances you can not create monthly premiums

Our home Sensible Refinance Program (HARP) are a step submit for the Federal government, which provides several options designed to help people, based on their private activities.

Relevant Financial Stuff

The newest Federal Homes Administration (FHA) enjoys revealed highest FHA financing constraints having 2025. These represent the mortgage constraints to have unmarried-family unit members houses purchased within the FHA loan system to own domestic genuine house to four tools sizes.

What do you have to know in the loan assertion? Using FHA lenders examine numerous items regarding an FHA mortgage software, and you can being aware what they appear to own can help you most useful ready yourself to own the next time.

FHA loan rules allow downpayment let that fits FHA and you will financial conditions. You can buy down-payment current money assistance from your state agencies or any other authorities program, moms and dads, and you will companies.

First-day homebuyers usually are concerned about the level of its down payment specifications with a new mortgage. That is one reason why FHA mortgages are very attractive to accredited borrowers – the three.5% advance payment specifications is a wonderful alternative to almost every other mortgages.

An enthusiastic FHA financial can be found in order to anyone who economically qualifies and isnt simply for earliest-day homebuyers otherwise those who have never owned possessions just before. Eg Va home loans, and you may USDA mortgage loans having outlying components, brand new FHA financial program is a government-backed financial.

FHA home loans commonly restricted to basic-day homebuyers, nevertheless the FHA mortgage system is an excellent choice for those individuals with never had a property just before–you will find a reduced down-payment requirement and much more versatile FICO score advice to have FHA mortgages.

Relevant Questions and you will Solutions

If you reside in a residential district that experienced flood, fire, a hurricane, or a tornado, HUD even offers assistance into the Presidentially declared emergency section. Save is actually described into the formal HUD site in fact it is available when it comes to a temporary fo.

It could be more challenging to locate an FHA financing if the you are notice-functioning, particularly when you are in the early level of the community. Lenders constantly like to see a great borrower’s money along the very previous couple of years. Big occupation transform at that moment will get gi.

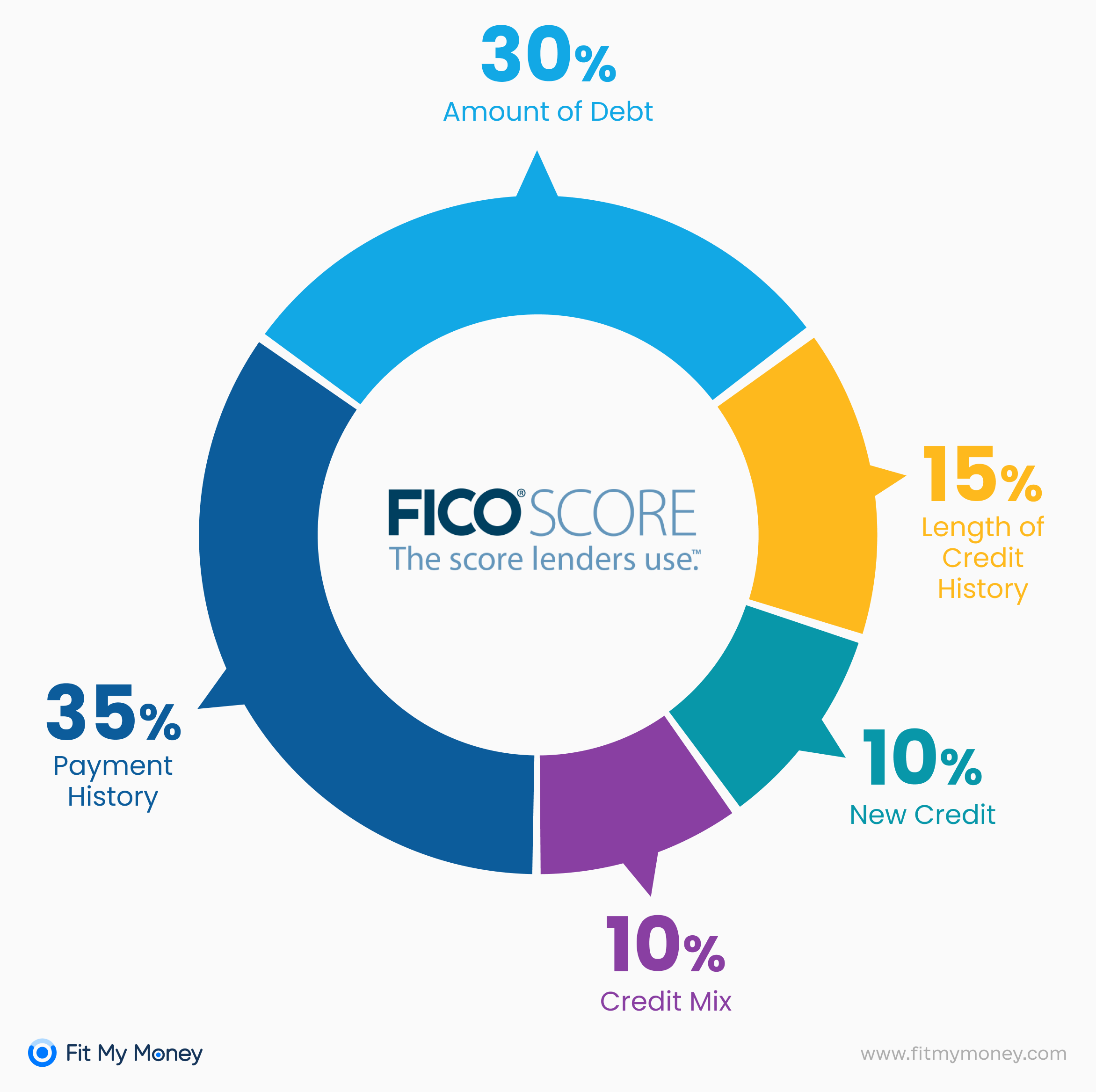

One of the most important aspects of getting your credit score in form before applying having a keen FHA mortgage loan was time. If you feel the credit is during bad shape, you’ll want to expose commission precision over a period of from the the very least one year be.

There was you to significant mistake you to definitely homebuyers can simply build when implementing to possess an FHA mortgage. Its and then make a major borrowing from the bank get just before or during the application for the loan techniques.

Needless to say, we wish to help make your month-to-month home loan repayments punctually and you may avoid problems with the FHA financing installment schedule. Both, life goes into the way in which. It pays to obtain before conditions that can damage your own credit otherwise produce property foreclosure.

The minimum down-payment is actually indicated for the portion of the borrowed funds, not in the a dollar matter. FHA mortgage legislation identify this number is step 3.5% of the property speed, in some instances the lender may require a higher down fee comparable to 10%.