Starting a property renovations excursion feels as though undertaking an exciting adventure loaded with options. But really, the price is going to be a critical hindrance. Household remodeling authorities financing reach the fresh rescue, providing an economic lifeline to those thinking from transforming their houses without having any significant cost away from traditional funding tips. These funds are created to bring obtainable financing choices, and work out your home improvement goals possible.

Start out with Limited Upfront Will cost you

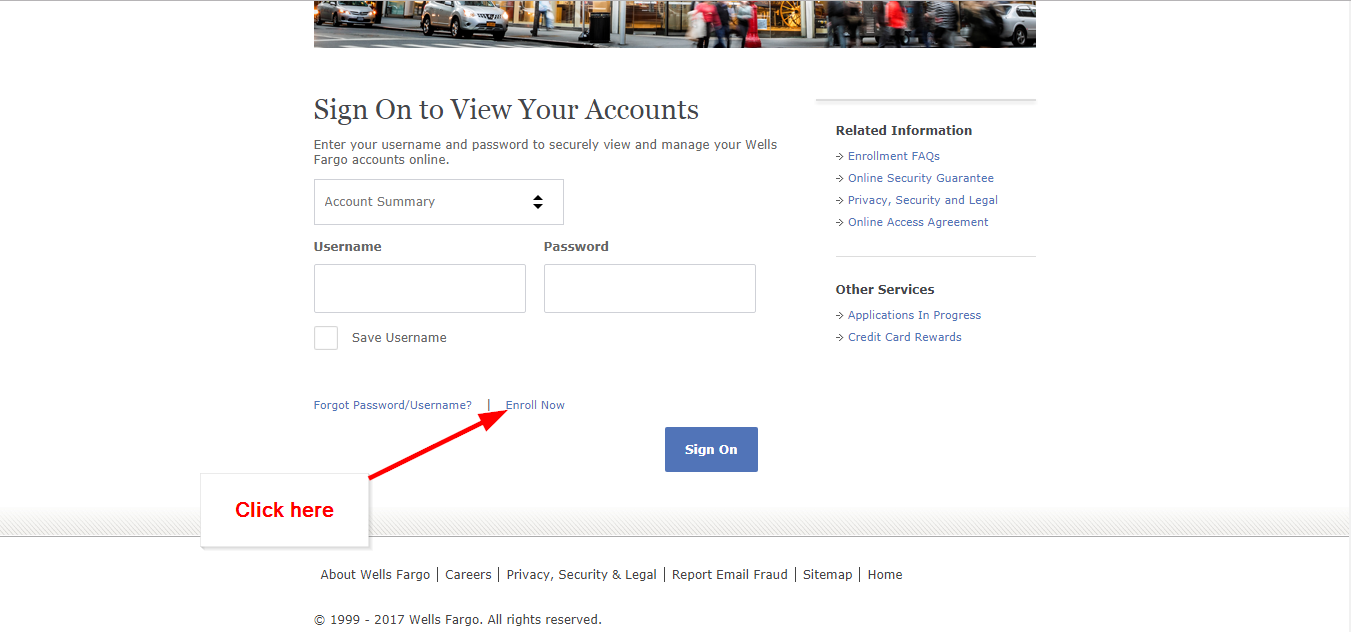

![]()

A primary test for most in relation to home improvements is the initial debts. Home remodeling authorities finance reduce which weight by providing lowest otherwise sometimes zero downpayment solutions. This pivotal feature permits home owners so you’re able to start the recovery strategies in place of the newest daunting task of protecting a big sum of money ahead of time. Its a major method, putting some goal of improving your liveable space a great deal more obtainable than previously.

Appreciate Inexpensive Monthly obligations

High-rates of interest toward old-fashioned finance can be rather increase the price of household ideas. In contrast, home remodeling government financing is actually described as its down interest rates. Which advantage means smaller monthly installments, enabling you to allocate a much bigger part of your allowance on the genuine home improvements. Ultimately, your not merely spend less over the time of the loan and also gain new versatility to buy new renovations one to count really to you, of visual upgrades in order to important repairs.

Incorporate a wide array of Systems

The fresh versatility from house renovations bodies fund is one of their most attractive features. Whether you are addressing urgent solutions, trying enhance your home’s energy efficiency, or perhaps looking to enhance its looks, these types of money deliver the self-reliance needed to protection an intensive variety from recovery projects. So it independence implies that you may make tall developments not just help the appeal of your house and also its possibilities and market price.

Strong Dive to your FHA 203(k) Finance

The brand new FHA 203(k) loan, backed by the fresh new Federal Property Government, is very very theraputic for homeowners looking for a thorough option to funds both pick and recovery of a home. It mortgage simplifies the credit processes from the combining this type of costs on the a single financial, so it is an ideal choice having comprehensive restorations methods.

Information FHA 203(k) Finance

FHA 203(k) fund are created to assists the purchase and you will after that restoration regarding a house which have just one loan, removing new complexity and extra expenses associated with securing several finance. Which sleek approach not merely conserves day also currency, therefore it is a nice-looking option for potential property owners.

Who can Work for?

Qualification getting an FHA 203(k) loan requires conference certain standards, like a reasonable credit score and you can a personal debt-to-earnings proportion you to definitely aligns with the program’s assistance. Simultaneously, the home need to be a minumum of one year old and you may tailored to accommodate that five families, expanding the probabilities to own prospective consumers.

Strategies so you’re able to Safer an enthusiastic FHA 203(k) Loan:

- Deciding on the best Financial: Start with determining a loan provider that’s licensed to give FHA 203(k) financing.

- Intricate Enterprise Considered: Come together with a certified company to make a detailed policy for your own restoration, in addition to a precise costs guess.

- Loan application Procedure: Complete your detail by detail recovery package together with your app to the selected lender.

- Being able to access the income: Immediately following acknowledged, money are held inside the escrow and put out to your contractor in the grade, ensuring the latest restoration progresses considering plan.

USDA Area 504 Money to possess Rural Homes

USDA Area 504 loans are specifically targeted at people in the outlying elements, aiming to create house secure plus comfy. This option focuses on fixes and you may improvements you to increase the life standards away from rural property.

Goal and you may Pros

The reason for USDA Part 504 fund should be to fund the fresh new resolve and you may improve from rural homes, prioritizing ideas that increase cover and you can livability. This includes from crucial solutions to help you high system upgrades, getting a general scope away from help to possess home owners.

How-to Meet the requirements:

Eligibility to possess an excellent USDA Point 504 financing depends on issues like area, earnings level, and method of getting alternative investment possibilities. The home should be the applicant’s primary home and you can located in a place seen as rural of the USDA.

Protecting good USDA Mortgage:

- First Session: Step one relates to seeing good USDA financial expert to assess eligibility and you can discuss the offered tactics.

- Software Techniques: Complete and you will fill in the desired documentation, as well as economic info, property suggestions, and an extensive arrange for the fresh new proposed renovations.

- Approval and you can Mortgage Disbursement: Following acceptance, funds are provided, probably for the values, to facilitate the newest active government and you may end of your recovery enterprise.

Promoting the many benefits of Your house Renovations Government Finance:

To make the a lot of domestic renovations authorities funds, comprehensive planning therefore the number of educated builders are fundamental. A very carefully felt budget and you will a thorough opportunity plan are crucial to be sure the restoration remains within this economic restrictions when you are finding the wanted consequences.

Detail by detail Planning and Cost management

A successful renovation begins with a well-thought-aside bundle and you will a clear budget. Functioning directly together with your specialist to guess can cost you correctly and you will bundle to own unforeseen expenditures is very important. That it preparation assists with maximizing the many benefits of your loan, making certain that all money is actually invested wisely.

Selecting the most appropriate Builders

The prosperity of their building work endeavor heavily hinges on the product quality regarding design. Going for contractors which have a good background and you may experience in programs like yours is a must. Additionally it is good-for come across positives familiar with the requirements of domestic renovations regulators fund, because they can navigate the procedure more efficiently.

Navigating the brand new Recognition Techniques

The journey to help you protecting a government mortgage to own household restorations is cover in depth checks, appraisals, and you can adherence to certain advice. Perseverance and careful focus on outline are essential from inside the successfully navigating this action. Making sure all the records is done and you can real, being available to info demands, normally facilitate acceptance.

Achievement

Household restorations authorities fund render an useful and you may appealing services to have home owners desperate to boost their functions. Towards support and you can freedom available with apps including FHA 203(k) and you can USDA Section 504 funds, doing many do it yourself tactics becomes more accessible. By the stepping into cautious thought and collaborating which have skilled positives, you can make use of these types of funds to carry your vision for your where you https://paydayloancolorado.net/cascade-chipita-park/ can find lives, creating a space one reflects the desires and you can develops the worth.

Of these thinking about a property facelift along with research off advice, we have been here to greatly help. Furthermore, pursue you to the Instagram having motivating renovation tales and you may resources. Let us carry on which happen to be elevate the wonder and you may features of your home to one another!