Regarding easily changing home loan business, technology performs a crucial role within the increasing efficiency, streamlining functions, and improving consumer feel.

Mortgage app was a pivotal equipment having financial positives, offering numerous pros one to drive the industry forward. Regarding revolutionising the mortgage origination technique to optimising customer service, financial application empowers agents and you may loan providers to prosper during the a competitive sector.

Comarch, which provides finance companies which have a complete suite of products to fulfill consumer need, keeps browsed the great benefits of financial app.

Borrowing from the bank agents, especially big agencies and you will professionals having extensive sense, try much more implementing specialized home loan app. Regardless if home loan software program is maybe not a new concept, its play with of the creditors and you can mortgage brokers possess surged during the during the last 36 months. Which rise is due to the software’s capability to automate and you may speed up processes if you are fully handling buyers means.

Specialised home loan mentor application somewhat boosts transformation with just minimal effort, particularly of the alleviating the burden off documentation, Colines the loan origination procedure, therefore it is more effective. The application was user-friendly and does not wanted state-of-the-art They experiences, enabling financing officers to cope with the entire loan processes, from initiation so you can papers completion, hence increasing yields.

One big advantage of home loan software to have borrowing from the bank agents is the power to generate shorter borrowing from the bank decisions. Automated studies accelerates promote generation, ultimately causing highest customer satisfaction. Agents is run selling alot more affairs without having any repeated tasks out-of checking device parameters, carrying out complex data, or completing tough copies. The new automation of one’s application for the loan processes then advances results, Comarch explained.

Documentation is a big issue to own borrowing from the bank brokers, but financial application address contact information it by the dealing with loan records into the conformity with interior and you can regulatory requirements. Work such registering borrowing from the bank apps, tape customer group meetings, and you may getting ready accounts are smooth, decreasing the go out used on such affairs.

Intelligent broker permits better customer relationships and you can a very personalised approach so you can borrowing from the bank sales. They supports this new origination and you may management of home security financing, guaranteeing successful operating. Brokers can simply analyse available lender now offers, compare borrowing can cost you, and choose the best option equipment. The application supports most of the phase of the borrowing procedure, out of simulation and you may application submitting to help you verification, bank import, and you can contract signing.

Using in a position-generated templates and you can automated verification helps to control mistakes when you look at the advanced mortgage programs, based on Comarch. The software program will bring appropriate loan quotes, discussing all of the costs. The fresh defined organization processes assures agents complete all of the called for measures during the a specific order, encouraging a typical method for per visitors.

Home loan advisor software improves functions organisation, providing advisors manage the loan techniques efficiently, out of pre-qualification so you can acceptance. It also facilitate when making customer database and you will entertaining calendars to have meetings and you can jobs, and also make file government a lot more manageable.

An effective loan origination system assists financial institutions and you can loan providers create loan documents, comply with requirements, and you may improve processes

When employing, home loan software lets businesses to monitor staff member issues and track the collaboration that have customers. It helps home loan experts because of the streamlining processes, automating menial employment, and you may uniting individuals, expertise, and grade for improved profitability.

Several options assistance brokers, however are just as active. Key aspects to consider when deciding on app tend to be user-friendly data-input, consolidation along with other It options, and in balance report age bracket.

money to loan Castle Pines Village, CO

The application of layouts and you may models accelerates the credit procedure, and achieving most of the data and you can documents regarding system simplifies recovery and you may management

Lenders normally fool around with individuals software units, plus Consumer Matchmaking Management (CRM) application, Mortgage Origination App (LOS), file government application, compliance and you will regulating app, financial data and revealing products, telecommunications systems, and you can financial underwriting app. These power tools assist brokers carry out surgery, bring expert services, and you may navigate the loan processes efficiently.

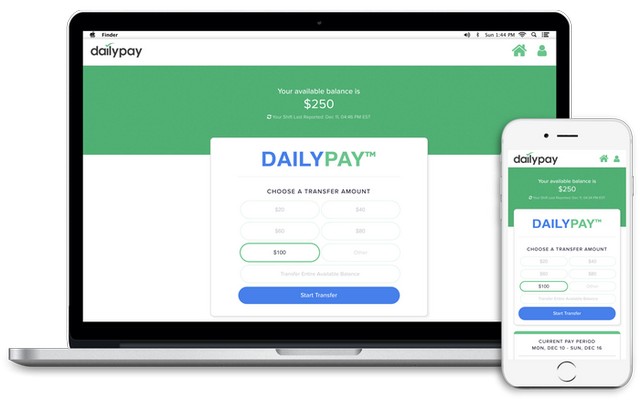

When deciding on financial app, gurus should think about interactivity, smart phone compatibility, and configurability. These features help lead customers connections, offer study supply away from home, and permit loan providers to cope with organization processes parameters efficiently.