Key takeaways

- A house Security Credit line (HELOC) is the most flexible and much easier resource solution to suit your 2nd highest purchase, capital otherwise restoration.

- A great HELOC’s mark period can be your windows of your time the place you can be borrow money since you need it up toward recognized borrowing limit count.

- A beneficial HELOC’s cost months is right following draw months where you start repaying their bank toward fund you put within the mark several months.

One of the most preferred concerns lenders rating in terms to help you home security personal lines of credit, otherwise HELOCs, was, What is the difference in a blow and you may fees months? And it’s really not surprising that – there is a lot to unpack with respect to these! Let’s answer some of the most prominent concerns.

Q: What exactly is good HELOC?

A: A beneficial HELOC is actually a personal line of credit that is determined by the amount of equity you really have of your property. You might basically acquire around 80% of worth of your house, minus everything nonetheless owe. There have been two attacks when you look at the a great HELOC – the brand new draw months and also the cost months.

Q: What exactly is a suck period and how can it performs?

A: This new draw several months for an effective HELOC work similarly to a cards card – you could potentially use around their approved count towards the years of your draw period, that’s typically 10 years. You will be given an appartment add up to borrow on, based on the equity you really have of your house.

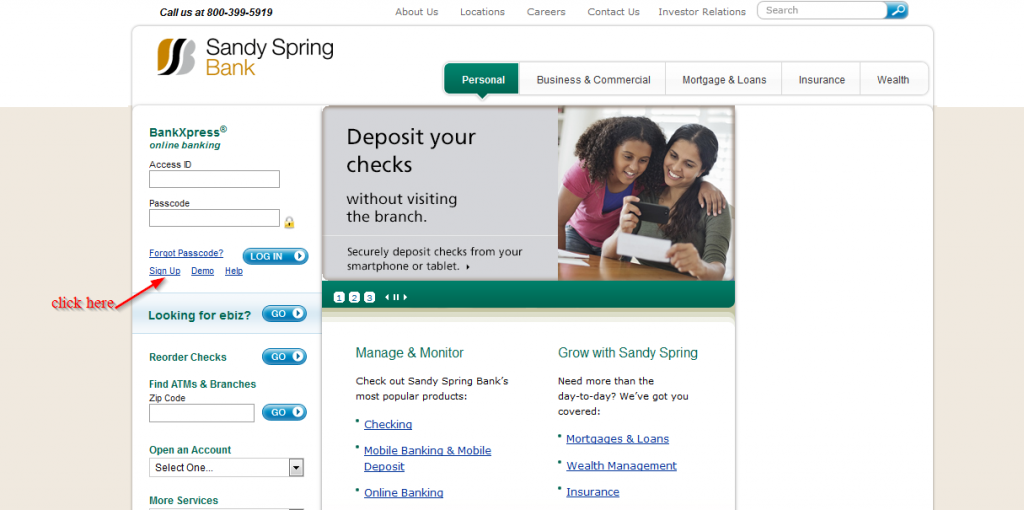

The new draw period ‘s the very first time of the distinct credit which you yourself can typically availability from the composing a, transferring funds due to on line banking otherwise using your mobile banking app. Although not, these processes may possibly not be available with most of the lenders that will also be at the mercy of limits. You can withdraw money normally given that you want, and you’ll only have to spend appeal about what you have lent inside the mark months.

Can you imagine you are taking out a HELOC to have $twenty five,000, and you need to develop a to the company to possess $5,000. You’ve still got $20,000 offered to draw on the later, and you will probably only have to spend focus toward $5,000 that you already drew.

Q: What is the HELOC fees several months?

A: The fresh new fees several months occurs due to the fact draw months stops, which is normally 10 years once you begin using the newest HELOC. It is possible to don’t manage to america cash loans Hamilton obtain from your credit line, and you might start trying to repay extent which you borrowed into the upper notice payments which were already taking place throughout the the brand new draw several months to the amount borrowed.

The fresh new installment months may sound far away, but you can’t say for sure in which you are inside 10 years. If you have the function, you might consider putting away money today during the expectation of the following repayment period. The bank might even provide systems just like all of our Residents Coupons Tracker, 1 where you are able to place economic needs in their mobile app and you will availableness the tools you really need to perform a personalized savings bundle.

Monthly obligations (and additionally dominant and you will focus, not just appeal for example when you look at the draw period), will start regarding payment period. Typically you’ll have as much as 20 years and also make these repayments. For individuals who repay your own HELOC before the prevent out of the draw months, you may have to shell out an early on fees punishment, but it utilizes your own lender.

Their monthly payment amount relies on the quantity your borrow, and your HELOC’s interest. They often keeps variable rates, so that your repayments you are going to increase.

Q: What is actually a great HELOC perfect for?

A: A HELOC is great for programs having very long time episodes otherwise fluctuating, repeated can cost you eg domestic resolve, studies, aging set up remodels, etcetera. Some individuals may also put it to use to own debt consolidation given that rate of interest is much lower than a credit card. It is generally better to make use of good HELOC just for something that will escalation in worthy of, however, lifestyle goes, and costs can come without warning.

Q: How do i start-off?

A: You should research additional banks as well as their current HELOC attract cost, people benefits they could promote when opening you to, and you can any type of prepayment charges which may use. You can see critiques to decide and therefore lender is best for your requirements. When you feel sure, it is time to incorporate – and you will constantly do that correct online! At Owners you can expect Owners FastLine, our award-successful digital application experience which allows you to receive a HELOC reduced along with shorter documents. You can get a personalized give in two to three minutes and you can financial support in as little as 14 days.

With many options for loan brands and loan providers available, it is very important would what is best for you along with your economic condition. Opting for Residents function opting for more than 100 many years of experience and you may expertise from the financial business – and you will a financial that is right here so you’re able to each step of your means.

In a position getting People FastLine?

While you are trying out a remodelling investment, merging large-attract debt or if you simply want an anxiety-100 % free holiday, a people HELOC can help you right now. And you may our house equity professionals are right here to greatly help direct you.