Student loan interest levels depend on the loan style of and you will borrower. Most recent rates for government student loans are about 5-seven.5%.

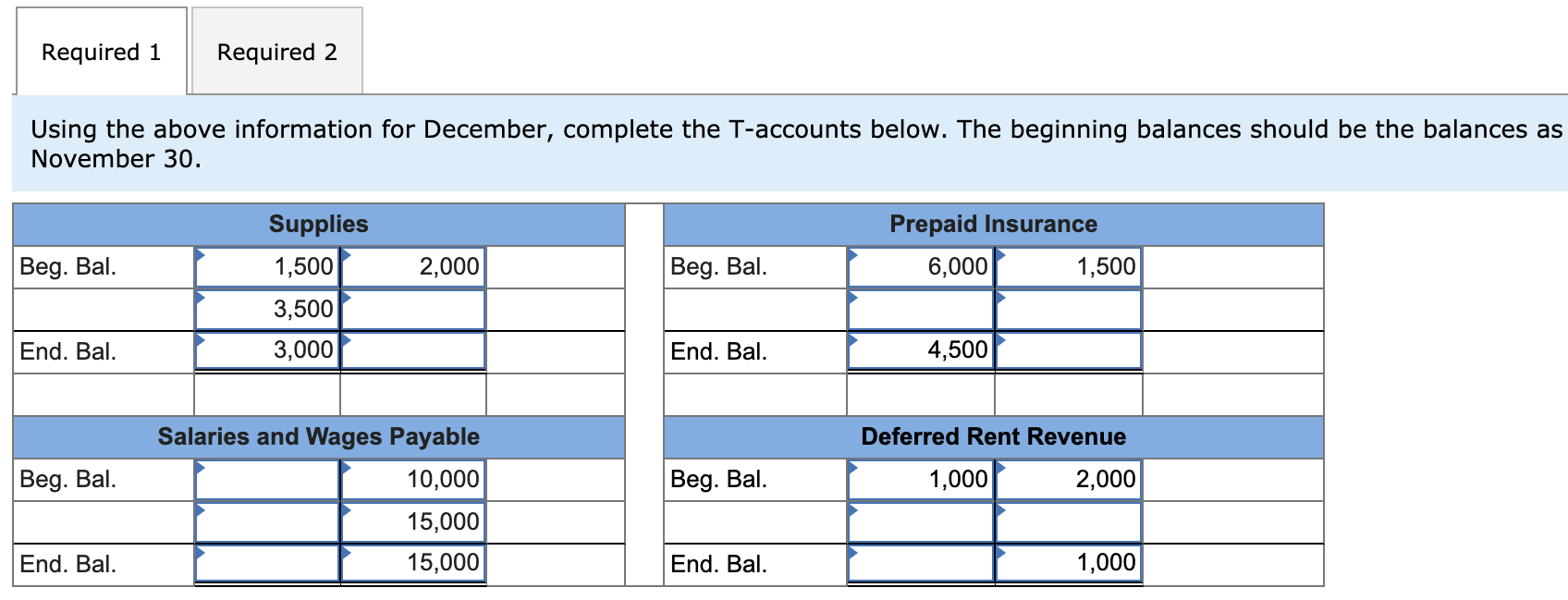

Current Education loan Interest rates

Government and personal figuratively speaking may charge notice in another way. Government fund constantly charge a predetermined rate of interest, definition they never transform over the financing term. Private figuratively speaking can offer fixed otherwise adjustable costs, meaning the speed was susceptible to changes month-to-month.

Current Government Student loan Interest levels

Federal loans to possess undergraduates, scholar children, and you can mothers enjoys more interest rates. This new Government Pupil Aid Office condition interest levels for everyone federal figuratively speaking all the July.

Current Education loan Interest levels and you may COVID-19

In the very beginning of the pandemic, government entities enacted a beneficial 0% rate of interest to your federal student loan loans and you will paused education loan installment using . The data more than echo rates outside that period.

Private Loan Interest levels

Personal mortgage rates of interest vary because of the financial and you will debtor. Loan providers offer you mortgage loan predicated on your credit report or any other activities.

Certainly the better individual finance to own 2022, an average fixed interest rate selections of 4.2-nine.8%. The typical variable private student loan interest starts from the 1.9-10.9% (even though the interest will be different over the longevity of new loan).

Education loan Refinance Rates

Consumers should re-finance figuratively speaking which have various other lender to help you rating a diminished interest rate. Refinance costs cover anything from financial so you’re able to lender. Education loan refinance prices as well as rely on the brand new borrower’s credit history as well as the the fresh loan’s label duration.

Of an example from six private lenders, mediocre fixed education loan re-finance pricing range from 3.7-8%. Mediocre varying education loan refinance cost start between dos Delta installment loan bad credit no bank account.2-eight.4%.

Education loan Fees

Of many lenders charges individuals charge on the student education loans. This type of you’ll are a loan application payment, control charge, or a late commission to have failing continually to generate repayments promptly.

Latest Government Student loan Fee

Government funds charges individuals a fee at disbursement – i.age., once they discharge money. Disbursements generally exists after all session otherwise one-fourth.

Individual Education loan Costs

Particular personal lenders costs app, origination, otherwise later percentage charge. Particular loan providers exactly who waive application otherwise origination charges often still fees you to own later otherwise came back repayments. So, realize the loan contract meticulously.

- Application Fee: What it will cost you to find approved for a financial loan.

- Origination Fee: A handling percentage at the start of your loan term.

- Later Commission Percentage: A payment for forgotten your payment time -normally a share of your commission.

- Came back Percentage Commission: In case the bank can’t processes your payment on account of lack of money on your own account.

Student loan Rates of the Season

Federal student student loan interest rates has generally financial market meltdown. An average interest rate over the past 15 years involved cuatro.6%.

Out of 2006 so you can 2013, the attention pricing having scholar unsubsidized financing and you may Also fund performed not change. They resided within 6.8% and you can eight.9%, respectively. The attention pricing for those financing began fluctuating on 2013-2014 informative year.

What is the present education loan interest rate?

The present day government education loan rate of interest is cuatro.99% to possess student college loans. The speed is six.54% and eight.54% to have graduate unsubsidized finance and you may And additionally fund, correspondingly.

The present personal student loan rates usually include to 4.2-9.8% to own repaired pricing. Adjustable cost typically range from step one.9-10.9%.

What is the mediocre education loan refinance rates?

One of many half dozen loan providers i tested, the typical fixed education loan refinance price are step three.7-8%. These lenders’ changeable refinance rates start between dos.2-7.4%, an average of.

What’s an effective interest to possess an educatonal loan?

Because of the average fixed interest among loan providers we tested try doing 4-10%, a speed for the reduced end with the assortment was felt a good. The modern government student loan rate try 4.99% having undergraduates, which is less than of a lot personal financing rates.

- Youngsters don’t spend interest towards paid loans so long as they’ve been in school.

- Federal fund provide even more flexible payment selection.

- Borrowers which have government financing could possibly get qualify for financial obligation termination as a result of Personal Solution Financing Forgiveness or other software.

The thing that makes education loan attention so high?

Education loan interest rates commonly echo industry. The brand new Federal Set-aside recently raised rates, also interest levels into the government figuratively speaking. So it price hike together with has an effect on private lenders’ adjustable costs and you will pricing towards the new personal loans.

Government mortgage rates of interest are the same for all, however, personal figuratively speaking would be large for some people. Plus bookkeeping to have economic climates, personal student education loans plus account for next: