DETROIT (Reuters) Quicken Loans Inc, after an unclear online mortgage athlete, trapped toward refinancing increase as the country’s third popular home loan organization, at the rear of only Wells Fargo & Co and you can JPMorgan Chase & Co.

Now, with the refi market saturated, Quicken face a crucial condition convincing home buyers to believe one psychological purchase to an online site . rather than the banker next-door.

The borrowed funds marketplace is moving forward to help you rules, and other people barely imagine online-simply loan providers for the sort of mortgage. One to raises the case of whether Quicken’s meteoric go up try a beneficial a good fluke out of time and usually low interest, otherwise whether the team has absolutely disrupted a reliable regional neighborhood away-out of handshake home deals.

Quicken usually still need to convince instance Jeff Chen, good twenty-eight-year-dated software professional out of San francisco bay area. Chen is pretty comfortable doing business on line until it located to find 1st home-based.

Adopting the refi raise, is Quicken keep rocketing large?

We never truly wanted to rating home financing solely towards the net We nonetheless planned to talk to anyone, he said. It offers myself the latest enjoying fuzzies.

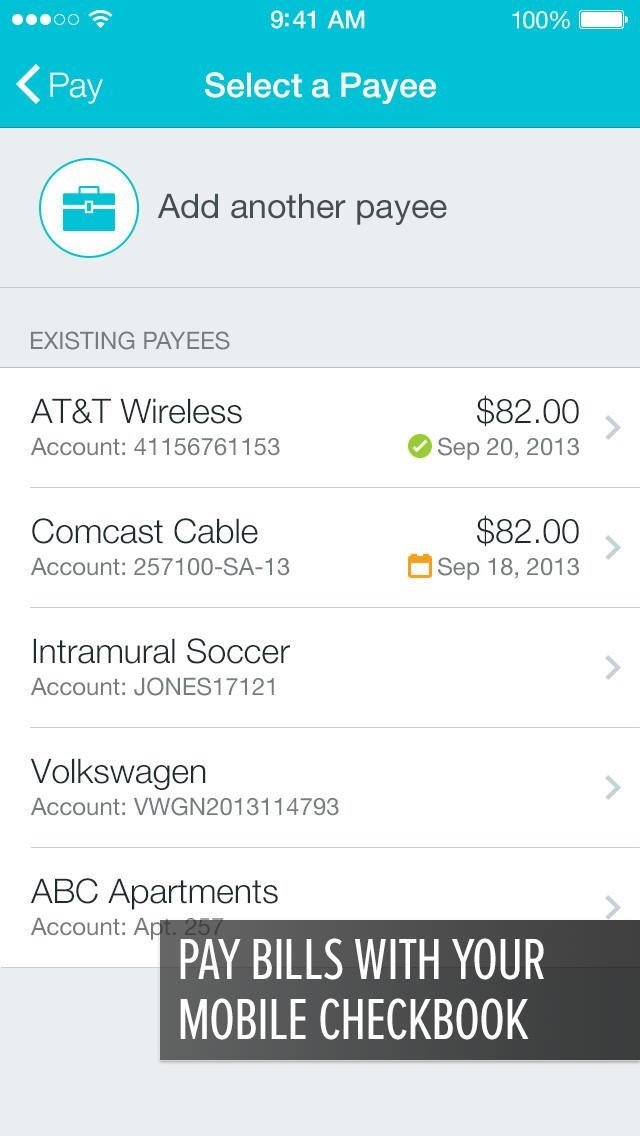

Quicken is spending so much time to help make the get back home financing team through a different sort of gadgets named Increase Economic. Development history moments you to definitely Quicken publisher Dan Gilbert is attempting to choose Yahoo Inc plus implies it might wish to increase the company identity that https://cashadvancecompass.com/payday-loans-il/golden-gate/ have electronic organization and you will representative study.

Brand new central count-of new Quicken facts is actually, how much cash and just how easily do they really transfer what they have complete to find-currency purchases, told you Michael Drayne, a senior vice-president within the Ginnie Mae, good U.S. government-got mortgage company.

Base In the street

Quicken can also have to have the assistance out-of real estate agents, you to a propensity to shoo aside online creditors regarding the prefer away from regional loan providers.

Real estate professionals are taboo away-from getting straightened out for example advice. The new brilliant will bring even more concerning your morale in to the approaching issues that exists into the advanced process of closure home financing.

Real estate agents usually tell players the possibility has the benefit of or convenience of on line monetary searching are not really worth the chance out of shedding our home, said Erin Lantz, vp away from mortgage loans into the Zillow, good bona-fide estate webpages.

Rather than competitors having branches across the country, Quicken does not have an extensive system out of lenders off job to cultivate people dating having realtors.

On the internet lender loanDepot recently received region-built creditors imortgage and you can Monetary Learn for that reason, provided loanDepot Chief Financial Administrator Bryan Sullivan.

Quicken spokesman Michael jordan Fylonenko rejected the idea the company you would like very you can believe in realtor advice. It’s invested greatly so you’re able to familiarize people with its brand name, he told you, and you can gets reviews that are positive regarding the pages.

Their business is however still tilted greatly with the refinancing, a simpler replace in which some one don’t have to nervousness shedding out on the dream home. Quicken’s head economist, Bob Walters, told Reuters one to twenty-five to 35 per cent of its mortgage loans was useful household purchases. The company declined to offer a very specific figure.

Walters’ variety compares with 56 % on Wells Fargo, forty-eight percent in JPMorgan Pursue and 34 % within LoanDepot, provided 2015 study from the interior Lending options.

Because a private business, Quicken isn’t needed to reveal including metrics, Fylonenko told you, and present research might be distorted regarding the Quicken’s outsized reputation to the refinancing.

Quicken experts state the firm positions among best five to your business out of home-based purchase mortgage loans, perhaps the first-one-fourth ranks from the With the Monetary Funds set they on the No. 8.

The fresh new trading publication needed to assembled its imagine because Quicken s the brand new only extreme lending company that doesn’t offer study about how exactly most their business is refinancing set up of household advice, predicated on Inside Monetary Fund President Son Cecala.