Very first, research and make contact with the loan lenders for you to do providers having. The financial institution then tend to assemble certain pointers and you can reveal for those who meet the requirements so you’re able to use, this new custom interest, mortgage label, and monthly payment(s).

Extremely lenders will allow you to use doing 80% of one’s property value your house (some HELOC organization allow it to be as much as 95%) without your debts on the no. 1 financial. Naturally, the more your obtain, the greater their payment per month could be. Need so it opportunity to decide meticulously how much money need and just how a lot of a monthly payment your financial budget are able to afford.

After happy with the new words, it is possible to done a far more thorough app. The lending company, therefore, will likely then would a more comprehensive underwriting. This consists of doing a hard remove of the credit history and you may demanding proof your revenue.

You might get a house security financing otherwise HELOC likewise to the way you submit an application for home financing

That have a house security loan, you’ll receive a lump sum payment to deposit in your bank account and rehearse as needed. Their lender gives a month-to-month cost agenda, also dominating and you can interest, therefore the loan’s identity. The loan title typically range of 10 to help you thirty years.

With an excellent HELOC, you’ll be able to draw towards the readily available finance (to a lump sum for your recognized number) and use that money as required. Fort Collins loans Since you reduce the new HELOC throughout the years, you can buy additional money at any point when you look at the draw several months (generally speaking ten to fifteen decades).

If you have a primary financial, you’ll make the household guarantee loan otherwise HELOC payment while doing so towards the number 1 mortgage payment. Due to this this type of borrowing choices are often called 2nd mortgage loans.

Just as in an initial financial, you will need to satisfy particular minimal requirements so you’re able to qualify for a beneficial home collateral loan or HELOC. These vary of the bank but generally speaking become:

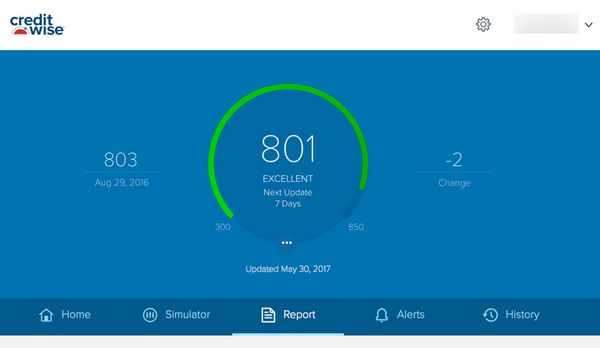

- Good credit

- The very least amount of equity in your home and you may minimum mortgage-to-worthy of proportion

- Proof of constant income to show your ability to repay brand new financing

- A low financial obligation-to-money (DTI) proportion

Your own lender can also need a separate home appraisal to ensure their residence’s well worth and to assist dictate the level of security available for you. Some lenders may even have fun with an automated home valuation, which will help improve the process.

Your qualification and individualized interest rate will be based how well you meet an effective lender’s conditions. For-instance, a higher credit rating and lower DTI ratio need to have you much more favorable terminology.

HELOC example

What if we would like to hire a contractor to complete certain renovations operate doing your residence. Your goal is to try to upgrade a number of their spaces and you can include value to the assets.

You earn several estimates and select a specialist quoting the task from the $fifty,000. The fresh specialist estimates looking for 9 weeks to-do the works.

Your home’s appraised well worth are $350,000, and you have an effective $150,000 home loan harmony. You calculate your equity from the subtracting the borrowed funds balance regarding the home’s worthy of.

Your discuss good HELOC along with your lending company. The lending company prequalifies one to use around 80% of your guarantee.

Your apply at obtain $75,000. This may security the $fifty,000 estimated cost of the work when you are making a beneficial $twenty five,000 cushion of cash having prospective overruns and other significant costs.

The lender approves the HELOC within an effective 5.5% changeable rate of interest with a great 10-12 months draw months, with a 20-12 months cost months. Your get the fresh company and mark funds from this new HELOC due to the fact had a need to pay money for the task. The minimal repayments in draw several months was notice simply ( you have the choice to expend along the prominent while the well). As the mark several months concludes, you only pay each other appeal and you will dominant.