Home financing is considered the most preferred opportinity for good homebuyer so you’re able to buy an item of possessions. In the place of paying the complete number within the cash, buyers can be finance the cost of the home through the years owing to a mortgage. But determining exactly what home loan is perfect for your unique need and you can disease should be hard. This is when a mortgage consultant will be.

An interest rate agent helps you see the certain mortgage circumstances out there on provided second also let express the process of using and you can hopefully delivering accepted. In spite of the pros, a mortgage consultant isn’t necessarily suitable for everyone. Read on understand what home financing agent really does, exactly who is work with a mortgage associate, and exactly how it change from a large financial company.

Precisely what does a mortgage consultant would?

A mortgage representative support a borrower dictate an educated mortgage equipment due to their specific credit means. Capable bring, compare, and explain the more mortgage products in industry now and you can assist choose the best mortgage equipment with the particular borrower dependent on their financial predicament, which will is amount of deposit, credit score, debt-to-income ratio, or the sorts of possessions being purchased. They also can use this particular article so you’re able to “look around” and support the best interest rates and loan conditions to suit your certain requires.

You will need to clarify one to home financing representative isnt a beneficial home mortgage inventor. They will not would and you can underwrite the loan but rather help move the loan process along, operating individually into the financing administrator. Simply speaking, work will be to very first make it easier to choose the best mortgage system, glance at the loan application, and eventually assist enable you to get earlier in the day loan acceptance so you can closure.

Instead of a mortgage broker, another financial consultant can not work that have anyone loan company; alternatively they work which have numerous loan providers, definition he’s got a wide pool regarding mortgage circumstances to decide out-of to help you most useful suffice their clients monetary goals or requires. Extremely home loan specialists work on an agent institution that gives them a greater variety of facts of a broader and much more varied home loan company pond. This can include an alternate mortgage origination or refinancing an existing mortgage towards property.

Why does home financing associate get paid?

Mortgage experts try paid back a payment for their properties, which is a portion of one’s complete loan amount repaid only if the mortgage was closed. The cost generally speaking falls anywhere between 1% – 3% and will differ according to the particular broker you are working which have and must feel revealed through a binding agreement in the event that dating starts, and additionally detailed with the closing declaration if your loan is approved. You due to the fact borrower are responsible for make payment on percentage, but many times this is additional into the settlement costs and you will paid off in the closure, or perhaps in some cases it could be rolling to the loan count and you may reduced from the lender within closure.

Just who will be work on home financing consultant?

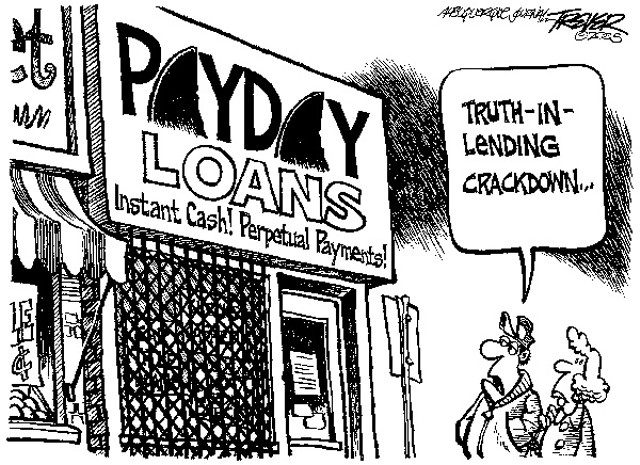

Financial consultants aren’t right for someone. If the a beneficial homebuyer are positive about the payday loans Hawai borrowed funds tool they’re going to used to funds the genuine property — for example. if they’re going with a conventional loan — it might not become really worth the costs. In case you’re looking to use alternative mortgage software, as with industrial a residential property, or hoping to get specialized mortgage system, having a home loan consultant to your benefit can be a huge help and you may experience biggest coupons.

By the shopping around and making use of its options and you may expertise in brand new certain applications and financing possibilities, the efforts will save you plenty so you’re able to hundreds of thousands of cash in your financing will set you back through the years. Since you would having some body you place to the real estate people, look around and make sure you can see ideal consultant, one that is keeping your welfare and needs since their consideration and it has the experience, studies, and you can proper identity that really works along with you.