- Had written

Reason why Construction Money Is almost certainly not Perfect for a renovation

For just one, loan providers features an intricate draw procedure that are going to be frustrating getting both the homeowner while the contractor working on the latest renovations. The house would-be susceptible to several monitors from inside the renovation. Structure fund require also enough paperwork to save your panels moving smoothly. Plus, mortgage continues are released incrementally as the project goals is fulfilled, which could lead to delays.

You will also payday loan Lyons have to refinance your existing mortgage should you get a houses financing. This will be costly when your current rate is actually low a little boost of one % function thousands of dollars so much more paid-in focus along side lifetime of the mortgage.

Here’s an example: when you yourself have a thirty-12 months repaired-rates mortgage from $350,100000 and rate of interest try step 3.25 percent, you can shell out $198, inside the attention along side life of the mortgage. if the interest expands to cuatro.25 percent, you can easily pay $71, even more from inside the attention, otherwise $269,.

Additionally there is a distinction on the payment having dominant and you may notice. The brand new payment with the financing with an effective 3.25 % rate of interest is actually $step 1,. not, you are able to pay $step 1, per month towards loan on higher interest rate. That’s an improvement off $.

As well as, the latest closing costs are occasionally high because these are generally based on your an excellent home loan equilibrium and you can restoration funds. In order to teach, whether your latest mortgage try $450,100 along with your recovery funds was $150,100000, you are going to pay closing costs towards a good $600,one hundred thousand financing. Settlement costs are usually as much as step 3 per cent, thus which is a whopping $18,000 ($600,100000 * .03), compared to the $4,five hundred ($150,100 * .03) for individuals who merely paid back closing costs to the loan amount to have renovations.

RenoFi Loans: An alternative way to invest in Your home Improvement

Designers commonly a fan of design financing to possess home improvements, as well as for multiple reasons. Fortunately, there was a much better replacement for fund home renovations which is far better and affordable.

RenoFi Money supply the exact same enhanced borrowing energy given that build finance, without the troubles that accompany brings, inspections and you can comprehensive company engagement.

Residents can choose from a beneficial RenoFi Household Equity Loan, RenoFi HELOC otherwise RenoFi Dollars-Aside Refinance. You may not have to refinance your home, proceed through a number of monitors regarding the restoration procedure otherwise spend large closing costs.

Instead, RenoFi financing play the role of an extra mortgage, and that means you reach keep your current home loan rates. In addition to this, financing continues are going to be getting home improvements on your own most recent house or property you may be to order.

You’ll need a 640 credit rating to help you qualify, and you can use around 90 per cent of house’s after-renovation worth without your balance on the home loan (restricted to $500,000 loan degrees of $250,100 was subject to stricter eligibility criteria).

So you’re able to teach, guess you reside well worth $395,one hundred thousand, therefore owe $255,000 on your financial. You plan getting home improvements done which can boost your family worth because of the $75,100. In this case, you might be eligible for an excellent RenoFi Financing of up to $168,one hundred thousand ($395,one hundred thousand + $75,000 * .ninety $255,000).

There are not any restrictions into the variety of renovations you helps make making use of the loans, and you might enjoys up to three decades to settle that which you obtain according to the mortgage unit.

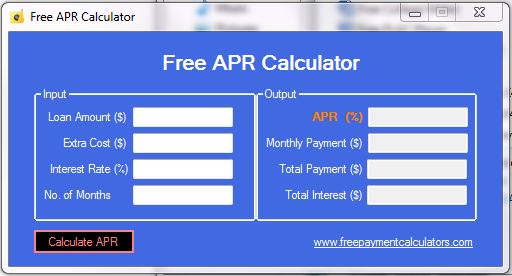

- 1: Utilize the RenoFi Online calculator to guage their borrowing power. You can consider estimated rates and you may monthly obligations getting family recovery financing facts out-of borrowing connection couples regarding the RenoFi network.

- 2: Should you want to progress, type in the brand new expected advice regarding the RenoFi self pre-meet the requirements product. Of course, if there was a fit, you are going to instantly become allotted to good RenoFi Coach who can answer any questions you have.

- Step 3: Collect the latest data you will have to apply for financing. Start by collecting your contractor’s contact information, a detailed costs imagine to own appraisal, renovation preparations the new specialist will use plus the preliminary renovation contract. Loan providers also demand economic documents, including your one or two newest spend stubs, a couple of years away from W-dos models, the most recent mortgage statement and you will proof home insurance. Together with, prepare yourself to incorporate statements from the previous a few months getting lender account, resource membership and later years account.

Maximize your borrowing from the bank energy and also have a payment per month you can pay for with an excellent RenoFi loan. Take the first faltering step on doing lso are domestic today.