Most Us americans hold an encumbrance out-of debt. Monthly expenses regarding handmade cards, figuratively speaking, vehicles financing and private money can seem to be daunting. For some, and make minimal monthly payments are eventually function all of them doing pay thousands when you look at the appeal. As mediocre mortgage rates will not list downs, of many property owners is actually capitalizing on the huge benefits a great refinance is offer. Of numerous borrowers check out the possible opportunity to consolidate loans and relieve month-to-month expenditures as the a major advantage of refinancing. If you find yourself a recently available homeowner, there clearly was a strong opportunity that you may possibly conserve having a refinance. Opinion this guide for more information on the methods good re-finance home loan can help you combine debt.

Do you know the Preferred Kind of Debt And how Can be Their Mortgage Help you Combine They?

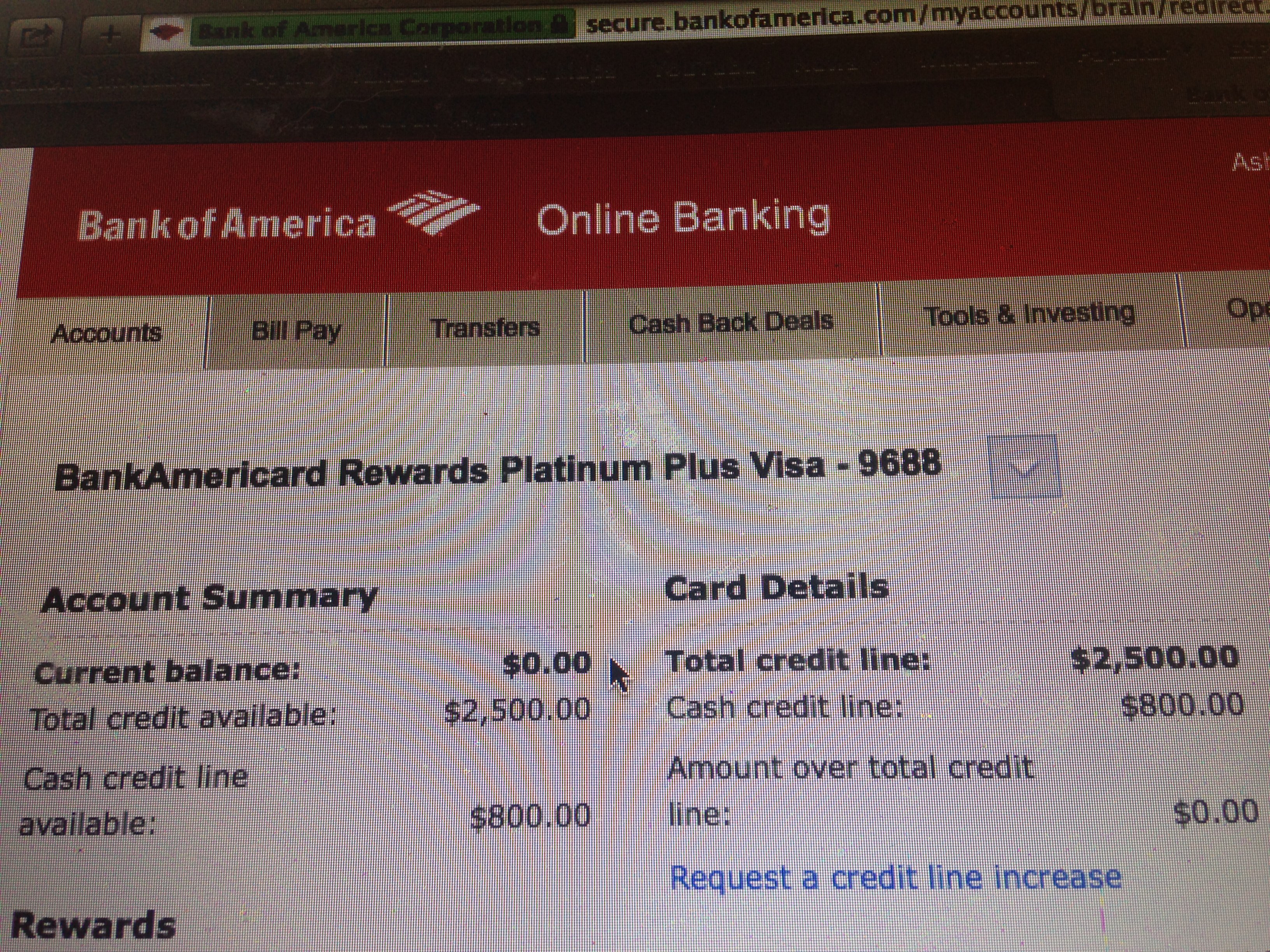

The most used kind of personal debt are charge card bills, medical bills, education loan bills and you may vehicles bills. A lot of which obligations stands for each day commands which can be very important to day to day life, unfortunately all of it accumulates. Credit cards was rapidly become the preferred type of commission certainly American users. Even when credit cards are simpler, become safer than simply carrying large volumes of money and regularly give attractive benefits incentives, most credit cards may lead you to a vicious cycle away from never-ending debt. Unsecured loans can help you consolidate financial obligation, however of a lot unsecured loan applications will have hefty costs. Luckily, because a resident you can access a secured item that will help you to get out of this vicious circle. While a recently available resident suffering from unsecured debt, a good refinance is generally a beneficial possibility to help you consolidate your debt, end using high interest rates and you may possibly reduce your monthly costs over time.

What is home financing Re-finance?

An excellent refinance is another home mortgage one changes your home mortgage. A beneficial refinance is not a supplementary mortgage otherwise lien on the possessions. Re-finance mortgage loans are only open to latest property owners because this variety of of loan is in exchange to own yet another financing. Often the the brand new home mortgage refinance loan gets an alternative speed, years, or structure sort of than simply good borrower’s latest home loan. Such as for instance, is-it well-known for a homeowner so you’re able to changeover off a changeable-rates financial so you’re able to a predetermined-rates home loan otherwise out of a great fifteen-12 months term in order to a 30-season label.

How do Interest rates Affect Your capability To settle Financial obligation

High expenditures associated with medical expenses otherwise emergency requests can simply go with the a charge card. Reduced daily expenses like gas otherwise lunch when created using credit cards are easily. Of many ?ndividuals are only capable of making lowest monthly premiums into the their growing mastercard balances every month. The debt is growing as more instructions are available. The common rates of all private playing cards try anyplace from fifteen 21%, and dependent on your credit history your own rate of interest was even higher. Many private student loan software in addition to charge interest levels of right up so you can fourteen%. Usually restricted monthly obligations are earliest used on paying interest and you may upcoming is put on decreasing the dominating financial obligation. Quite simply, it means you retain using, nevertheless the load never ever seems to come down.

Mortgage interest rates is located at three-season lows. Even at the the highest point in the last 10 years, home loan rates https://paydayloancolorado.net/hayden/ of interest haven’t surpassed 5%. Using a re-finance to help you consolidate loans would be a smart monetary means.

Sorts of Home mortgage refinance loan Applications

There are two brand of refinance loan fund, an increase and you may identity re-finance and an earnings-out re-finance. Common out of Omaha also provides both of these home mortgage refinance loan designs and you will can help you understand that’s best for your personal and monetary wants. As the label suggests, an increase and you will term refinance mortgage financing generally adjustment the eye rates and/or full asked quantity of months or decades during you will make home loan repayments.