While you are desperate to get a property but have no money getting a downpayment, you might be tempted to indication-on for a no-down financial.

While the thought of providing yet another band of house techniques in the place of dropping hardly any money within bank may sound tempting, there is certainly normally a disadvantage to anything this easy.

Preciselywhat are zero-down mortgage loans?

It’s probably been some time once the you heard anyone speak about zero-down lenders. That is because these include absent throughout the market for a while, but they have been starting to make a comeback.

This means that, zero-off mortgage loans is actually financing that one hundred% fund the whole price out-of property, reducing the necessity for a downpayment.

Sure, there are several funds which do not want a down payment. However, observe: they arrive having costs which get set in the borrowed funds.

- Department regarding Pros Things Fund (Virtual assistant Finance), which are available for licensed veterans, active-responsibility service embers, and specific people in the latest National Protect and you can Reserves. Although this loan demands no money off, you’ll find charge that can consist of 1.25% to 3.3%.

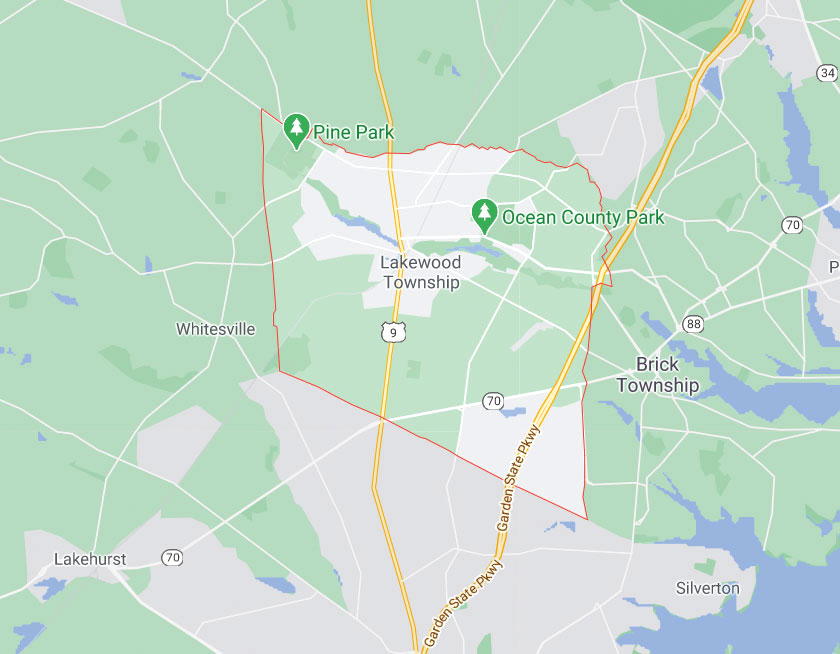

- Company regarding Agriculture otherwise USDA’s Rural Creativity home loan verify program. To qualify for the brand new USDA mortgage, you have got to live in an eligible city, meet particular house earnings standards, and be an initial-time homebuyer (though there are exceptions). Like the Virtual assistant loan, this new USDA financing boasts charge. There is certainly a 1% up-side make certain percentage and you will a yearly percentage out of 0.35% of your financing balance.

Simultaneously, there are some unique programs for instance the D that offers a no-advance payment in the event you meet the requirements. Particular borrowing from the bank unions supply these fund to help you professionals.

However, likely, you are going to come across low down percentage finance which need one set some money down. Extent you put upon this type of financing can be as lower given that step one%, however, normally, you are going to place step 3% in order to 5% down.

You will want to remember that these fund will require one to bring individual home loan insurance policies, otherwise PMI, that may include hundreds to your monthly bill.

What are the pros and cons off zero-money-down mortgage brokers?

Imagine to be able to head into a financial without an all the way down payment and you can leave to the secrets to your home. Music very near to best, proper? But not, there are certain things you need to be cautious about whenever you are considering a no-down financial.

When taking away a zero-down loan, you are subject to high interest levels while the bank notices you given that “high-risk.”

And additionally, you find yourself investment more. This involves you to definitely shell out far more interest over the years. Simply put, for folks who obtain extra money right up-front, you’ll encounter a high month-to-month mortgage repayment.

Well-known pro off a no-down mortgage ‘s the home they opens if you cannot manage to put currency down. This type of mortgage membership brand new yard and you may produces family control better to getting when you yourself have restricted financing and certainly will qualify with a loan provider.

When is actually a zero-off home loan a bad idea?

Actually going for among the low-down fee money is make it easier to be eligible for a lowered interest and better conditions. Plus, you will put away thousands into the focus and shell out less money more living of the loan.

A zero-down mortgage is an awful idea while you are to invest in good household during the a shorter-than-finest sector. We f you place no money off and the field requires a nostrils-plunge, the value of your residence is certainly going down (this is where the word underwater originates from). You may find oneself owing more than your home is well worth.

One other reason to stop no-down money has to do with building family collateral. For people who place no money down in the very beginning of the financing, you should have zero security built up.

Why is that instance an issue? Well, what if you’ve got a primary family disaster, just like your roof caving from inside the. When you yourself have collateral collected, you are eligible for a home collateral mortgage otherwise an excellent house collateral credit line (HELOC) to help you purchase the repairs.

However, strengthening collateral does take time and money. For people who go for a zero-off financing it takes considerably longer to create security.

Whenever was a zero-off home loan wise?

A zero-down financial is really put-to help you to get on a house if you don’t have the money secured to place toward mortgage best out. It is also a good idea Fresno savings and installment loan if you are planning to the getting set for some age.

not, prior to taking for the loan, be sure to have enough cash in your budget and work out new month-to-month mortgage payments

To put it briefly so it: it is best to lay some cash off because it will save you thousands ultimately.