When you manage an excellent Suncorp Financial credit expert, they will assist manage the fresh new having to pay of the dated domestic financing together with creating of your own the newest financing membership. For those who have an offset account with your latest financing and you will your unlock a unique Suncorp Financial transaction membership due to the fact a counterbalance facility, you need to use all of our account changing provider. That it simplifies the entire process of importing the important points of every payees you have conserved in your dated family savings.

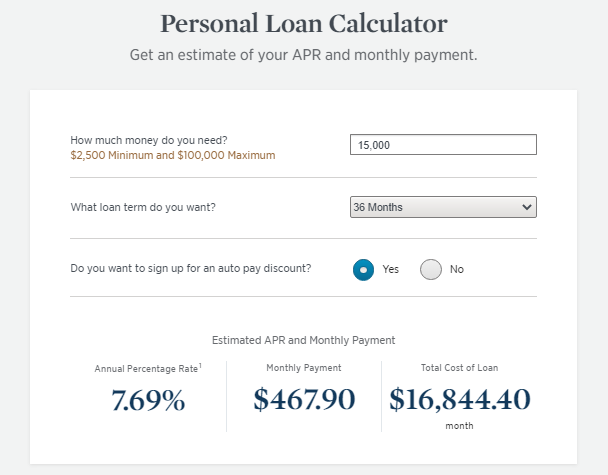

For a main and you may interest financial, you’re needed to shell out the very least month-to-month payment. It repayment will require you to definitely spend the money for desire fees since the better while the reduce the prominent number of the borrowed funds over the mortgage title.

To have an appeal-simply mortgage, you might need a max notice-only age 5 years. During this period, you will simply be asked to spend the money for desire charges. After the eye-merely months, you’ll revert to help you a main and appeal installment, you can also pay out the borrowed funds in full.

My personal newest financial is by using Suncorp Bank. Do i need to submit an application for refinancing?

You can connect with refinance your current financing to a different financial tool. If you are searching to view additional finance, an use Loan or Guarantee Financing would be a good option. A good Suncorp Bank domestic credit pro helps you know when the these could work for you. Confer with your devoted financial otherwise send us a safe content thru Websites Financial. We want you to settle for every aspect of the mortgage.

So what does financial refinancing mean?

Refinancing your house financing occurs when you switch your household mortgage to some other loan, constantly with an alternate bank. You are doing which if you take out a new mortgage which enables one shell out your current mortgage.

Why would We think refinancing?

You’ll find a range of reasons to believe refinancing. Recently, for many consumers how come so you’re able to refinance might have been to store currency of the using home financing which have a lower life expectancy desire speed. Individuals may also prefer to re-finance to obtain a new loan with an increase of has actually and you can payment liberty.

In the event the assets enjoys grown when you look at the well worth, your house guarantee have and enhanced. Refinancing may help you availableness your security getting things like home improvements, property using, to find a different auto and much more. Refinancing could help pay off large-notice bills such as for example playing cards and car and truck loans. This might make it easier to stretch your budget away from traditions and gain more control more your bank account.

Exactly how much guarantee can i believe refinancing?

A good rule of thumb is that you should have at least 20% equity in your home before applying to refinance. That way you can avoid paying Lenders Mortgage Insurance on your new loan. Find out more about equity and you will refinancing.

Whenever is almost certainly not a good time to refinance?

In the event the current mortgage is on a fixed rate, it may add up to wait up until the fixed several months concludes just before refinancing. This can help treat one very early fees or hop out charge your may prefer to pay.

Furthermore, if you are likely to be placing a house on the market in the near future, it may not sound right so you’re able to re-finance your home financing as the the latest short-label can cost you get exceed the potential experts how to get a quick $600 loan possible realise.

Finally, when your value of your residence provides diminished otherwise you take towards more obligations (otherwise your credit score keeps reduced for some almost every other reason), loan providers are a whole lot more careful of that provides a different sort of loan. If this is the case, it may be much harder so you’re able to re-finance your existing loan at the a lowered speed.