Crossbreed Fingers

Crossbreed Fingers start off with a predetermined-rates ages of anywhere from about three so you can a decade. Then, they have a changeable months where in fact the rates will get changes according to a catalog.

With the mortgage loans, the original rate of interest is generally below repaired rates mortgage loans. This new reduced brand new basic several months, the lower the speed is.

Speaking of written in a design where in actuality the basic count determines the time of fixed rates while the second matter the latest duration of the remainder loan. Particularly, 5/twenty-five Case form a predetermined rate of five many years accompanied by a drifting speed to possess 25 years. A beneficial 5/step 1 Arm could have an excellent 5-seasons repaired price and to evolve annually upcoming.

Interest-only (I-O) Arm

Interest-simply Arms require you to pay just desire into home loan to possess a set big date (3-10 years). After that timing, then you certainly beginning to spend on prominent and you will desire of the borrowed funds.

This could well be great Hot Sulphur Springs loans for people who actually want to save on the initial few years of its home loan, to make sure he’s got financing for another thing. Although not, going for an extended We-O period setting your repayments could be high just after they comes to an end.

Payment-solution Arm

- Pay for the principal and you will desire

- Pay down only the notice

- Pay the very least amount that doesn’t shelter desire

Although it ount or just the focus, might at some point have to pay the lending company right back everything from the the required date. This new extended you’re taking to settle the principal, the greater the eye costs was. The latest longer you pay from precisely the minimal, the more the fresh debts grow.

Whenever an arm works well

Is actually a supply effectively for you? For almost all homeowners around specific situations, an arm could be the wise financial solutions.

It is far from The Permanently Domestic

If you know our home you are to shop for is just one your intend to leave in a few ages, up coming an arm ple, if you plan to go out of county or get an effective home to meet your (and never future) needs, then thought an arm. You would score the lowest basic fixed speed, and then you certainly will sell the house before the interest rates have been adjusted.

Rapidly Pay off Home loan

Many mortgages try to own 15 otherwise 30 years, you might certainly repay it reduced. If you plan to pay your very own away from faster, then you might save money. If you know you will get a heredity, added bonus, or other financial windfall, then you may once more spend less for the lowest introductory rate. This is wise to see obtain the necessary currency till the prevent of your own repaired-speed period.

Lower Very first Money are Priority

After the initial fixed rates, the fresh guidance away from variable-speed mortgages isnt predictable. The latest benchmark you’ll miss, minimizing rates of interest. not, it could boost and cause interest rates to help you rise. There is absolutely no means to fix predict this with full confidence.

But not, if the reduced very first prices was the top priority and you’re okay on threat of higher money afterwards, following an arm is generally a great fit. An alternate key benefit of the lower rate is you can pay way more on the principal upfront, enabling you to lower your financing equilibrium because of the even more for people who like.

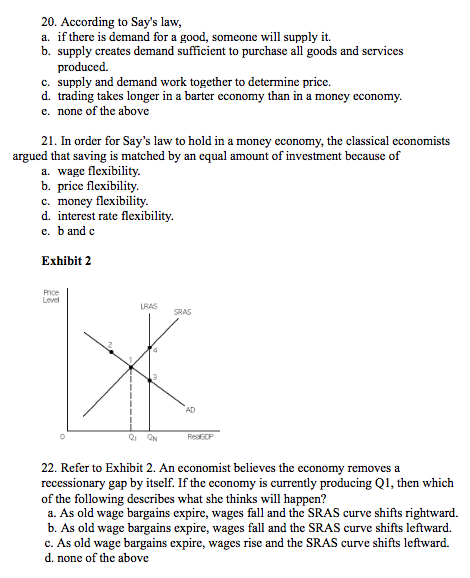

When you are Palms have their spot for some homebuyers, they aren’t constantly your best option. The original low cost are tempting, plus they causes it to be simple for you to get good bigger loan for property. However, fluctuating repayments try tough having budgeting. The brand new repayments changes significantly, that’ll put you with debt.