You have got a sense of what questions to inquire of when searching for a home, exactly what about the concerns to inquire of in terms of the mortgage application procedure? Somebody can get to get in our home to invest in processes rather than inquiring in depth or adequate concerns, Karry Lewis, Director regarding Mortgage Design in the Countries Lender.

How much does My Borrowing from the bank Appear to be?

First-date homeowners need to understand the necessity of building a beneficial credit history if you are paying its costs promptly, claims Lewis. Brand new worst-instance scenario are people which have less than perfect credit, bankruptcy proceeding, series to their credit report. They don’t have possessions, in addition they haven’t addressed their funds well. Making sure you really have good credit, stable income, and assets accessible to buy a house is a great place to start.

Were there Apps Offered to Help me to?

A massive misconception about purchasing property is that an excellent 20 percent deposit will become necessary. But not, may possibly not feel important for all mortgage transactions. If you purchase a home as opposed to a 20 percent deposit, their home loan company might wanted individual mortgage insurance coverage, which protects the financial institution in case there is a standard. Calculate home financing fee to see what you are able afford.

But there may be additional options too. You may be qualified to receive a veterans Items (VA) loan, and this means zero down payment, or Government Homes Government (FHA) mortgage, and this need a good step three.5 percent down payment. Certain applications actually permit present funds from qualified donors otherwise money out-of deposit guidelines applications for usage to own advance payment and you may closing costs. Head to HUD getting a listing of homebuyer software on your own state.

How to Rating Preapproved?

You need to feel equipped with an effective preapproval when you start interested in a home so as that once you discover something you such as for example, you are able to make a deal, even if keep in mind that preapprovals expire, so you should do so near the date you may be buying a home. Start both of these tips:

- Lookup and you can contrast lenders. Choose one that gives the mortgage circumstances you find attractive, and therefore understands your financial situation and requirements.

- Talk to a mortgage officer. You need to have a respectable conversation regarding the money and you may getting upfront, Lewis states. In the event that you can find prospective difficulties, then you may sort out him or her. The loan mortgage manager provide facts about degree for various particular mortgage loans.

Ought i Manage to Pay the Home loan to the Preapproved Count?

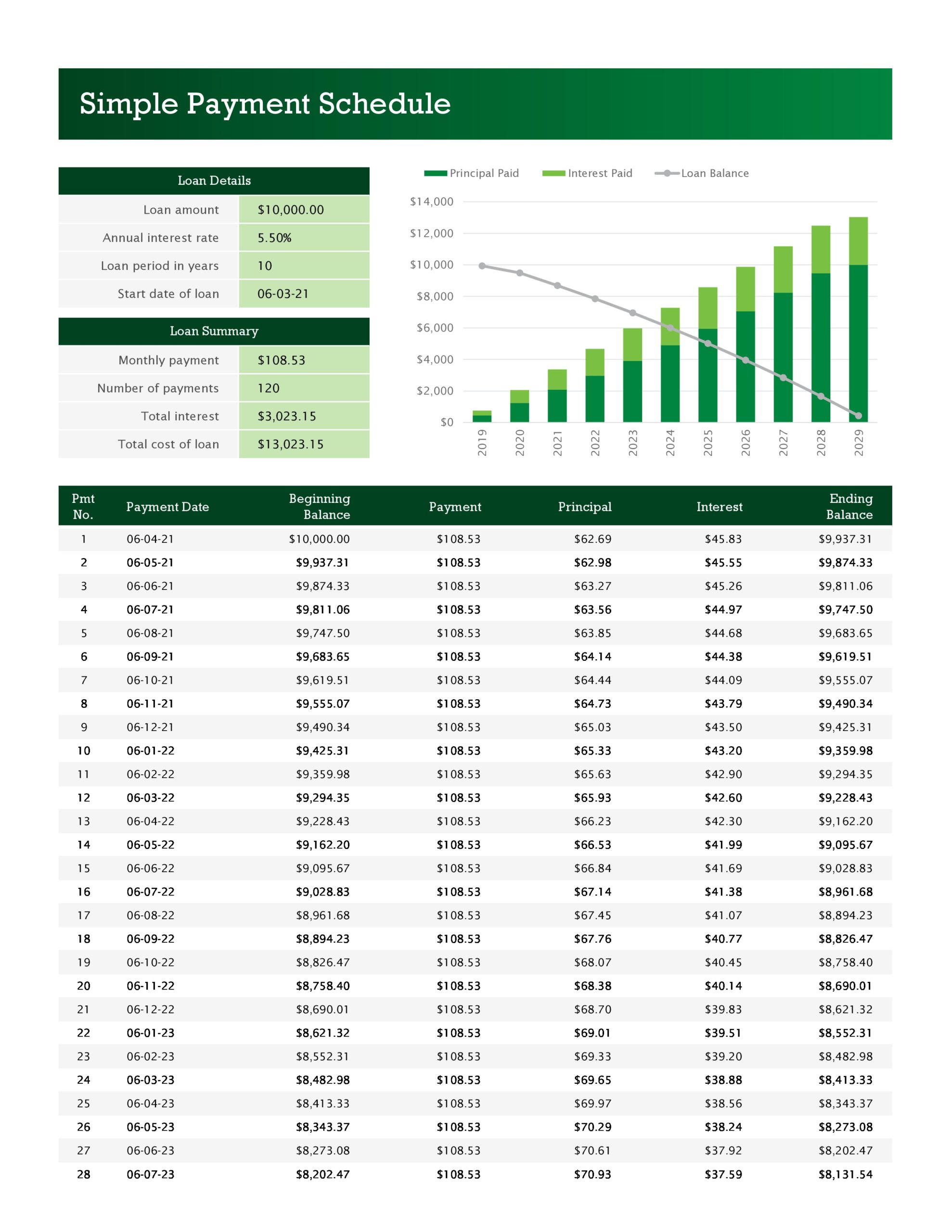

Since you plan for your next larger purchase, guarantee that you can comfortably generate repayments per month you to remain within your existing budget. Cause for fix while calculating your own month-to-month will cost you. Play with mortgage calculators to determine how much cash family you can afford.

When Should i Make a deal?

You like the location, the advantages of the home, and also the price. So it is time for you to build an offer that fits your finances. There could be specific deals that happen before deal try finalized, thus package ahead and leave a small go room to suit your offer.

Since seller welcomes the offer, you need to get property review to ensure the residence is for the good condition. For-instance, the house might look an excellent but may involve some invisible problems particularly water damage and mold or a failure foundation one a professional can get manage to find. Along with, whenever you are a first-go out homebuyer, envision delivering www.clickcashadvance.com/payday-loans-az/miami a home guarantee, and that generally speaking talks about repair and you will substitute for regarding significant domestic options and you will appliances on account of normal wear.

Exactly what Closing Records Must i Indication?

The amount of papers is going to be overwhelming, but definitely spend time and make certain new documents is actually direct. And more than significantly, constantly browse the small print. The user Economic Coverage Bureau Closure Disclosure Explainer helps you check all the info of your financial.

And also make Their Mortgage repayments

Their mortgage payment range between the main, desire, homeowner’s insurance policies, and you will possessions fees. When you have a keen FHA financing otherwise private mortgage insurance rates, the fee also can tend to be that expenses. Build your costs on time every month to keep your borrowing from the bank from inside the an effective reputation. A property buy is the greatest financial support people is ever going to make, states Lewis.

Once you choose you may be ready to plunge into the a home business, make sure you know very well what to anticipate when buying a house.